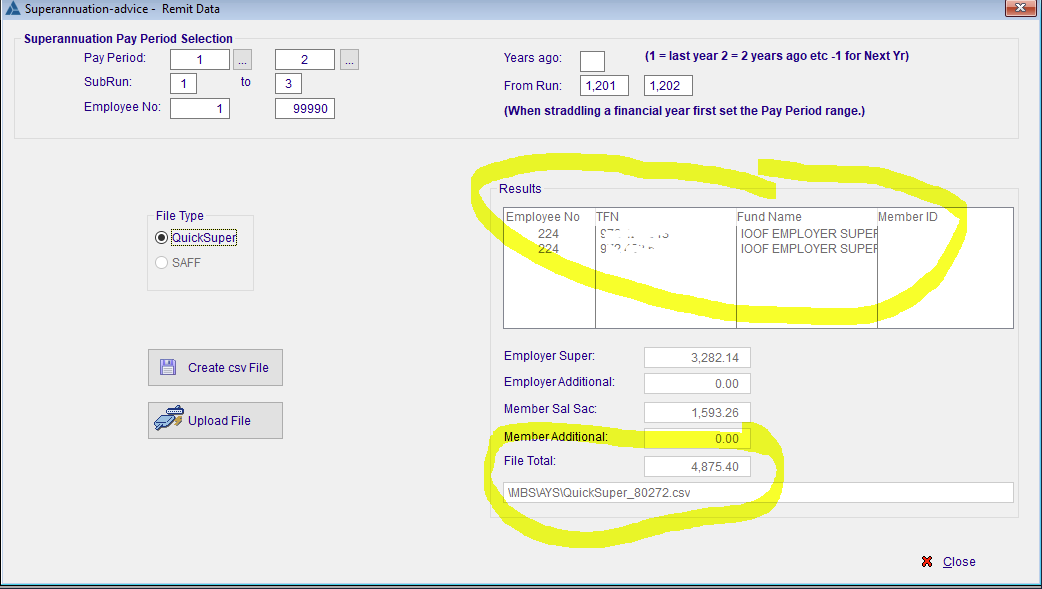

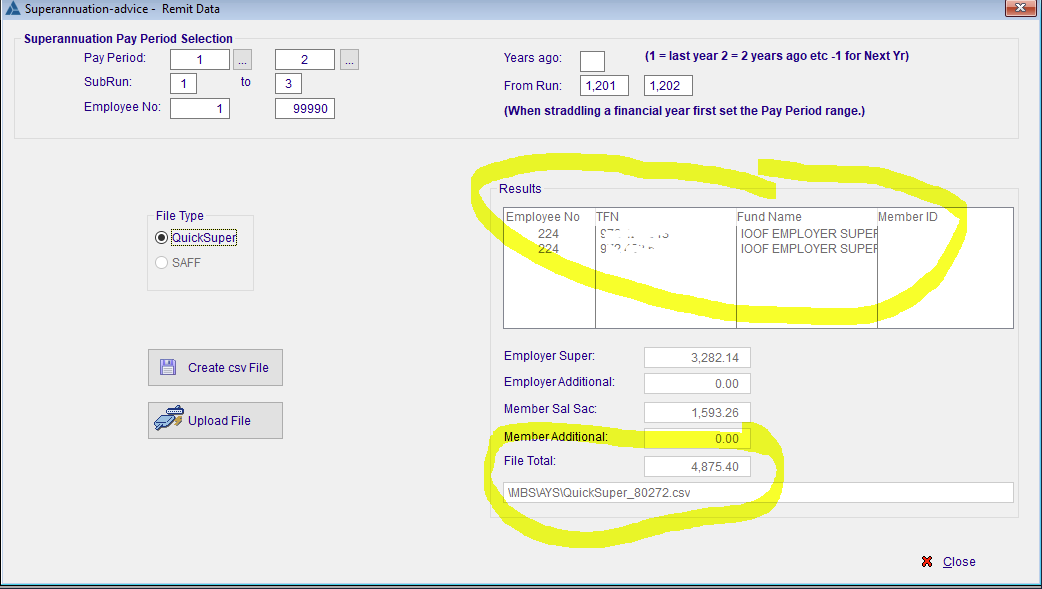

Check the Results

The table will detail missing information. This may need to be corrected before uploading the file. In this example employee 224 is missing the Member ID information for their Superfund.

Note - this procedure was streamlined Oct 2020

Initial setup is here.

Superannuation Clearinghouses are a very convenient way of updating your employee's superannuation contributions. By using the file upload function you are able to eliminate almost all re-keying of data.

Most clearinghouses work the same way (in truth, almost all are run by the same supplier), so this procedure should be fairly universal.

There are 2 basic file formats, Quicksuper CSV V2, and the more comprehensive SAFF. Currently we support the Quicksuper V2 format, with SAFF to come.

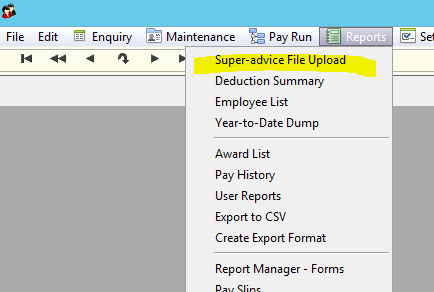

The procedure is located in:-

Payroll

Reports

Super-advice File Upload

Payroll

Reports

Super-advice File Upload

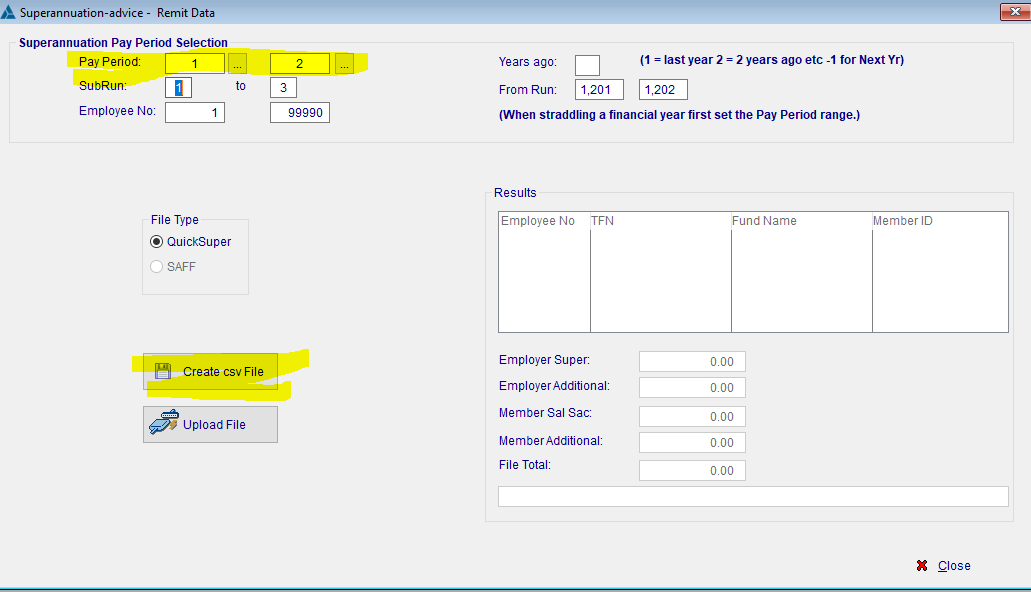

Enter the Pay Period details as required

Click on 'Create csv File'

Check the Results

The table will detail missing information. This may need to be corrected before uploading the file. In this example employee 224 is missing the Member ID information for their Superfund.

Employee Super correctionsTo correct the data, click on the employee and you will be taken to their Super details page. You will need to correct the first page (for future uploads), as well as manually update the 2nd page with the new details for those pay-runs. When you have completed those updates, you can click 'Create csv File' again & re-create the file. |

Note the Totals.

Note the location & name of the File which you will upload to the Clearing house in the next step.

|

Click on Upload File

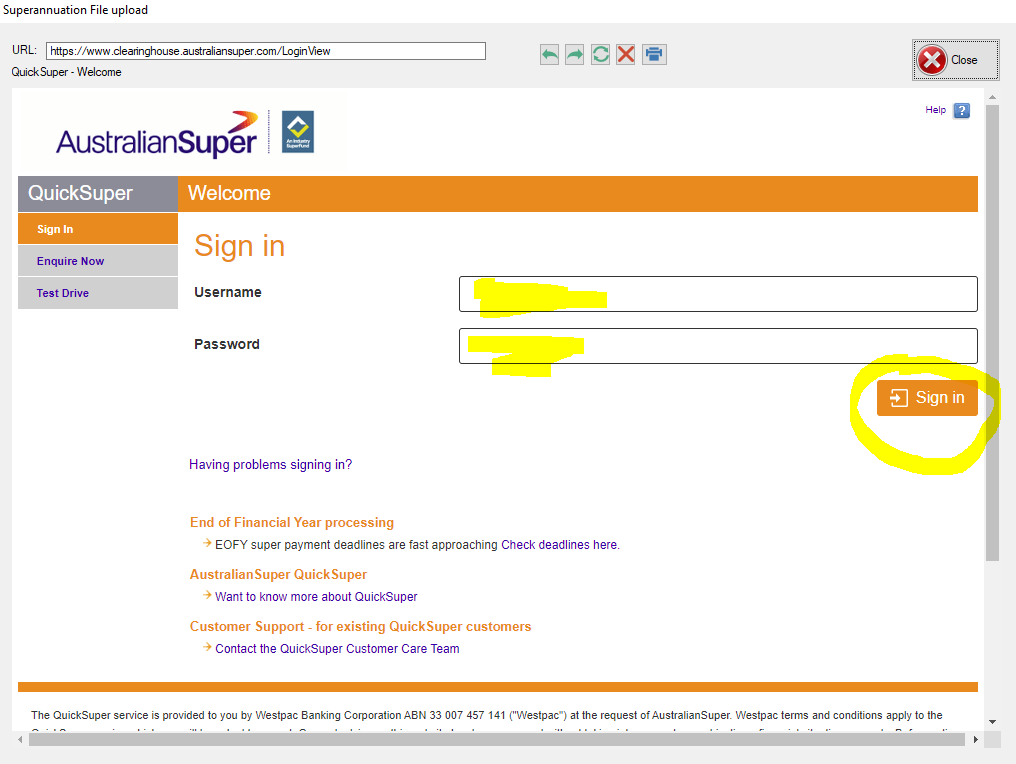

This opens your Clearing-house website for Login. (Your preferred Clearinghouse's website may look different)

Log into the Clearinghouse

Follow their instructions to upload the csv file you created above.

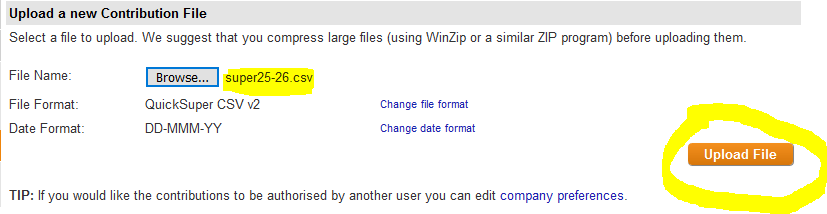

Browse - selecting the csv file you just created.

Leave the defaults for file format etc

Date format must be DD-MMM-YY though.

Click on 'Upload File'

The file will be uploaded.

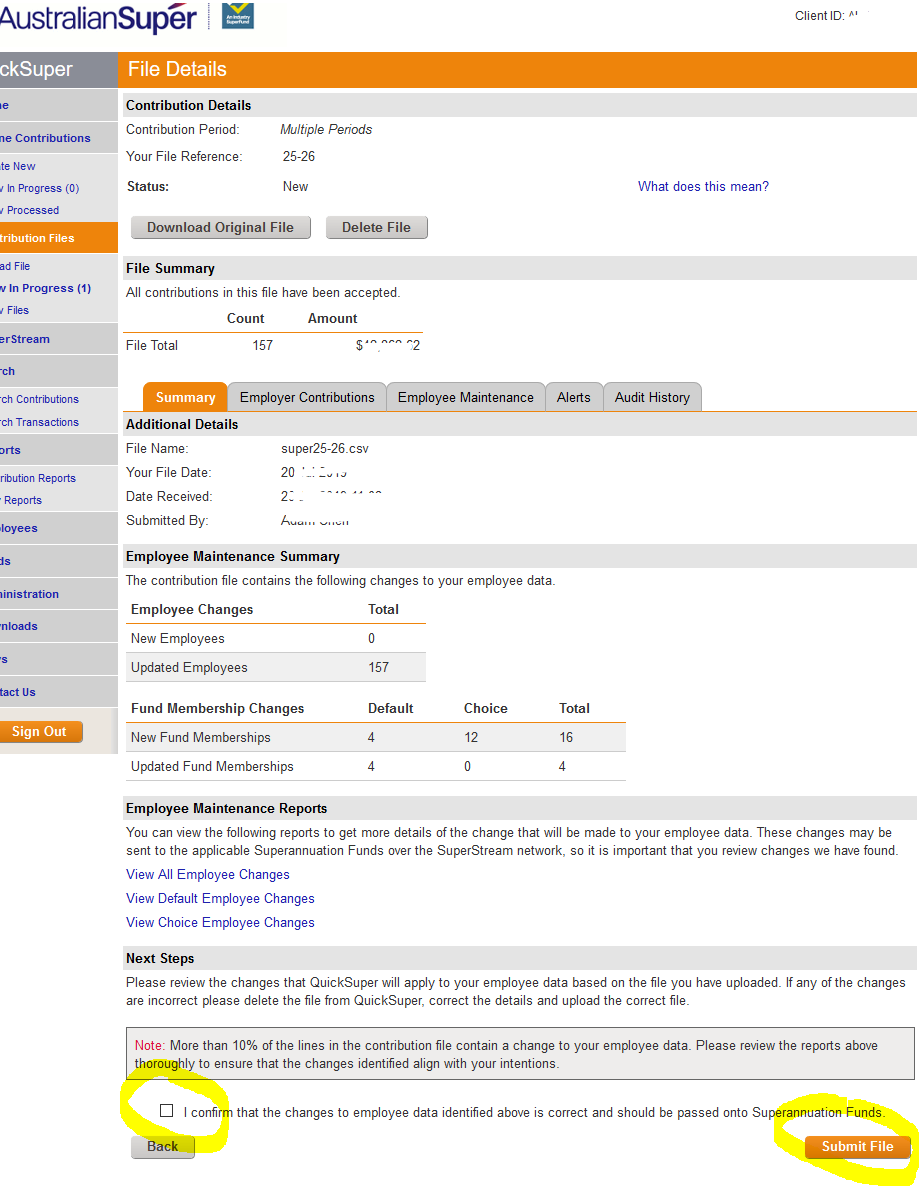

Under file Summary you must receive: -'All contributions in this file have been accepted.

If NOT, you must make the corrections in Minder & re-create the file.

If all OK, click the tick box at the bottom confirming any changes and then click on 'Submit File' at the bottom.

Do a screen dump of the page as it contains the EFT payment details at the bottom.

Sign Out