Works Orders - how costs are calculated & used.

Preamble

There are 5 methods available by which costs can be transferred from a Works Order to an Inventory Item.

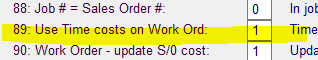

| Fset #89 | Works Order Costing method used |

|---|---|

| 0 | Actual Material costs, as applied by a Material Issue, PLUS Estimated Labour and Estimate Machine Cost at the Standard Labour Rate. Variation to COS accounts against Estimates. |

| 1 | Actual Material costs, as applied by a Material Issue, PLUS Estimated Labour and Estimate Machine Cost at the Standard Labour Rate. No Variations written. |

| 2 | Actual Material costs, as applied by a Material Issue, PLUS Estimated Labour and Estimate Machine Cost at the Standard Labour Rate. Variation to COS accounts against Actual Labour / Machine Costs. |

| 3 | Actual Costs, that is actual Material costs Plus Actual Labour and Actual Machine Costs |

| 4 | Reserved. |

The method used is selected via Fset #89 (1 - Set 5),

Admin ,

Configuration,

Feature Settings,

1 - Set 5,

Setting '0'

Actual Material costs, as applied by a Material Issue, PLUS Estimated Labour and Estimate Machine Cost at the Standard Labour Rate. Variation to COS accounts against Estimates.

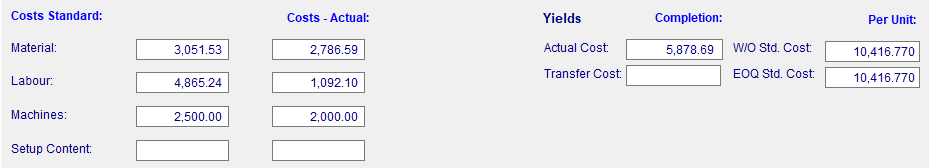

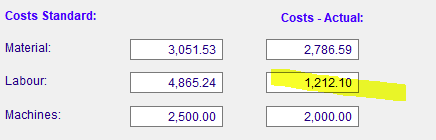

Our sample Works Order (55559) has the following in Tab2 - Values, the MI has been done.

Stocking

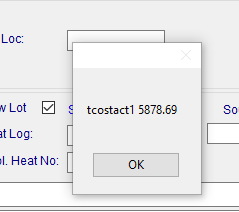

When we stock this Works Order, a series of dialog boxes appear indicating the values being used, simply step through them.,

Actual Cost per the WO

The Actual cost is made up of:-

| Material | 2786.59 |

| Labour | 1092.10 |

| Machines | 2000.00 |

| TOTAL | 5878.69 |

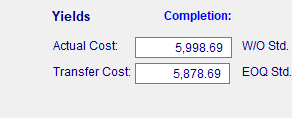

Stepping through the Dialog Boxes we end up with:-

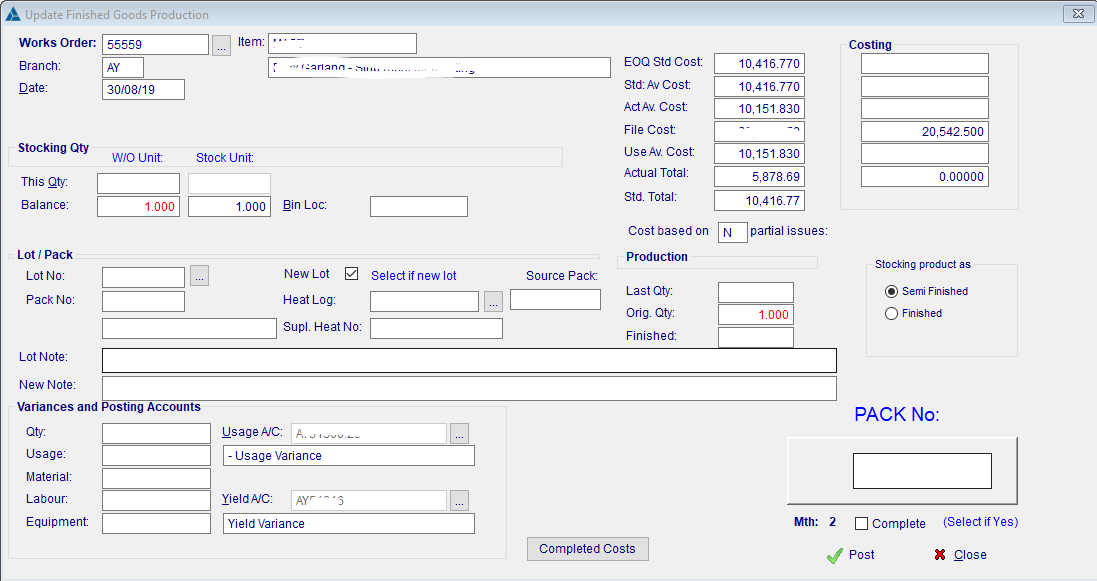

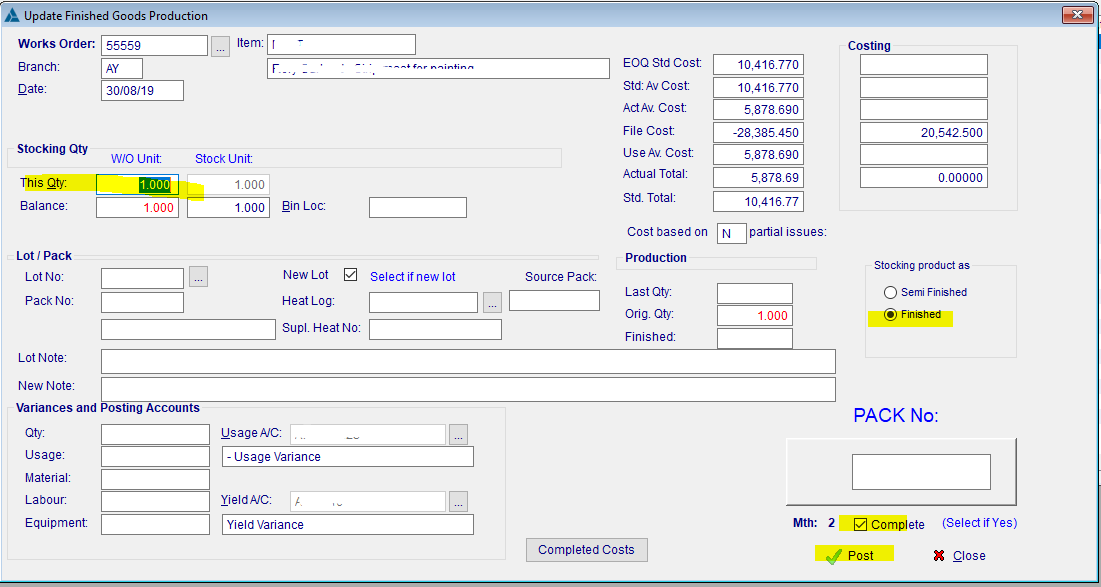

We now Stock this Item

- This Qty = 1

- Tick Box ' Complete' = Yes

Check the Transactions written

Now look at this Item in inventory, and check the transaction.

In the GL - AC1320 - Inventory Control Acct

In the GL - AC1330 WIP Control Accoount

The Item has been transferred from WIP to Inventory at the Estimated Avg. Cost. That is Actual Material, Estimated Labour and Estimated Machine. The Actual Labour and Machine Costs have been ignored.

2 offsets have also been written, the first ($4865.24) being the Labour Estimate as gone to Labour Cost Recovery, the 2nd ($2500.00) being the Machine Estimate, has gone to Yield Variance.

Together, with the original Material Issue $2786.69, they offset the WIP account, keeping it in balance.

| Transferred from WIP (AC1330) | ($10151.83) |

| Transferred into WIP | |

| $2786.59 |

| $4865.24 |

| $2500.00 |

| Total 'Recovery' | $10151.83 |

| Imbalance | $0.00 |

|---|

Analysis Available

- The Works Order contains both the Estimate and the Actual Values for Material, Labour and Machines.

- Invoice Cost on the Sales Order will be as per Work Order estimate.

- The Labour Cost recovery account is available for comparison against actual labour. This way you can establish if you are under or over recovering labour. An under recovery indicates either you have under estimated the number of hours, or your standard rate is too high. An over recovery similarly indicates that you are over estimating your labour, which could lead to losing orders.

- You would also be able to compare the Machine recovery should you use a separate GL account for those costs.

Advantage / Disadvantage

- Invoice cost is at WO estimate.

- WIP control account is balanced.

- Anaylsis is available both at the Works Order level and at the branch level (offset accounts vs actual accounts).

- Simple.

Setting '1'

Actual Material costs, as applied by a Material Issue, PLUS Estimated Labour and Estimate Machine Cost at the Standard Labour Rate. No Variations written.

Our sample Works Order (55559) has the following in Tab2 - Values, the MI has been done.

Stocking

When we stock this Works Order, a series of dialog boxes appear indicating the values being used, simply step through them.,

Actual Cost per the WO

The Actual cost is made up of:-

| Material | 2786.59 |

| Labour | 1092.10 |

| Machines | 2000.00 |

| TOTAL | 5878.69 |

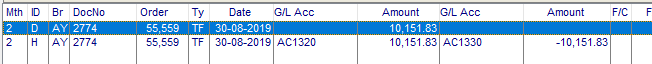

Stepping through the Dialog Boxes we end up with:-

We now Stock this Item

- This Qty = 1

- Tick Box ' Complete' = Yes

Check the Transactions written

Now look at this Item in inventory, and check the transaction.

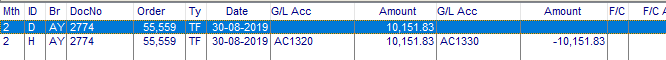

In the GL - AC1320 - Inventory Control Acct

In the GL - AC1330 WIP Control Accoount

The Item has been transferred from WIP to Inventory at the Estimated Avg. Cost. That is Actual Material, Estimated Labour and Estimated Machine. The Actual Labour and Machine Costs have been ignored.

No offsets have also been written, which means that we have transferred from WIP (AC1330) MORE than we placed in there. We will have an imbalance between the WIP ledger and the GL control Account.

| Transferred from WIP | ($10151.83) |

| Transferred into WIP | |

| $2786.59 |

| |

| Imbalance | $7365.24 |

|---|

This imbalance (between the actual WIP and the WIP control acoount) will need to be cleared regularly to a Cost of Sale account.

Analysis Available

- The Works Order contains both the Estimate and the Actual Values for Material, Labour and Machines.

- Invoice Cost on the Sales Order will be as per Work Order estimate.

- The value of the Journal to re-balance the WIP control account (AC1330 in this example) is available for comparison.

Advantage / Disadvantage

- Invoice cost is at WO estimate.

- WIP control account is not balanced and requires a clearing entry ideally each month.

- No offset accounts are used - simplicity.

- Anaylsis is available both at the Works Order level and at the branch level (correcting entry for WIP on a month by month trend).

- Very Simple, but requires clearing of the WIP control account. See Works Orders Outstanding WIP

Setting '2'

Actual Material costs, as applied by a Material Issue, PLUS Estimated Labour and Estimate Machine Cost at the Standard Labour Rate. Variation to COS accounts against Actual Labour / Machine Costs.

Our sample Works Order (55559) has the following in Tab2 - Values, the MI has been done.

Stocking

When we stock this Works Order, a series of dialog boxes appear indicating the values being used, simply step through them.,

Actual Cost per the WO

The Actual cost is made up of:-

| Material | 2786.59 |

| Labour | 1092.10 |

| Machines | 2000.00 |

| TOTAL | 5878.69 |

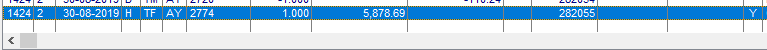

Stepping through the Dialog Boxes we end up with:-

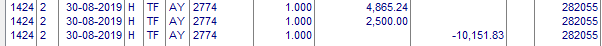

We now Stock this Item

- This Qty = 1

- Tick Box ' Complete' = Yes

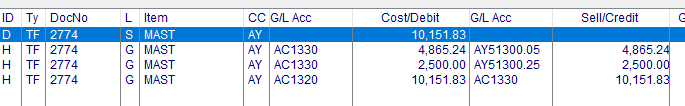

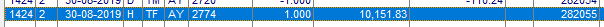

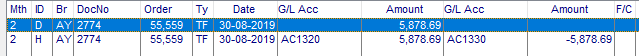

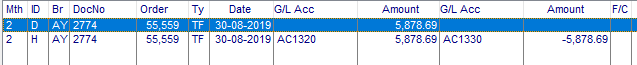

Check the Transactions written

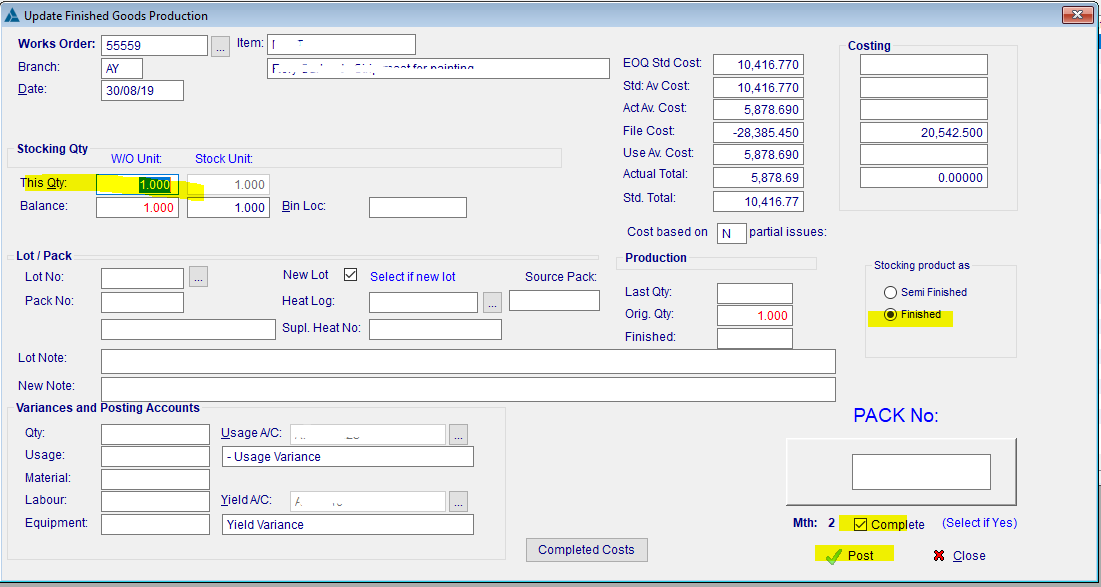

Now look at this Item in inventory, and check the transaction.

In the GL - AC1320 - Inventory Control Acct

In the GL - AC1330 WIP Control Accoount

The Item has been transferred from WIP to Inventory at the Estimated Avg. Cost. That is Actual Material, Estimated Labour and Estimated Machine. The Actual Labour and Machine Costs have been ignored.

2 offsets have also been written, the first ($3773.14) being the Labour Estimate LESS the ACTUAL labour has gone to Labour Cost Recovery,

the 2nd offset ($2500.00) being the Machine Estimate LESS the ACTUAL labour, has gone to Yield Variance.

Together, with the original Material Issue $2786.69, the original Labour and the original Machine Costs, they offset the WIP account, keeping it in balance.

| Transferred from WIP | ($10151.83) |

| Transferred into WIP | |

| $2786.59 |

| $1092.10 |

| $2000.00 |

| $3773.14 |

| $500.00 |

| Total transferred into WIP | $10151.83 |

| Imbalance | $0.00 |

|---|

Analysis Available

- The Works Order contains both the Estimate and the Actual Values for Material, Labour and Machines.

- Invoice Cost on the Sales Order will be as per Work Order estimate.

- The offset accounts are now true offsets available for comparison against estimates.

Advantage / Disadvantage

- Invoice cost is at WO estimate.

- WIP control account is balanced.

- Offset accounts are used - more complex.

- Anaylsis is available both at the Works Order level and at the branch level (offset accounts vs actual costs in GL).

- More complex as requires Offset Accounts, but allows for Posting before all time sheets are in (as they aren't used)

Setting '3'

Actual Costs, that is actual Material costs Plus Actual Labour and Actual Machine Costs

Our sample Works Order (55559) has the following in Tab2 - Values, the MI has been done.

Stocking

When we stock this Works Order, a series of dialog boxes appear indicating the values being used, simply step through them.,

Actual Cost per the WO

The Actual cost is made up of:-

| Material | 2786.59 |

| Labour | 1092.10 |

| Machines | 2000.00 |

| TOTAL | 5878.69 |

Stepping through the Dialog Boxes we end up with:-

We now Stock this Item

- This Qty = 1

- Tick Box ' Complete' = Yes

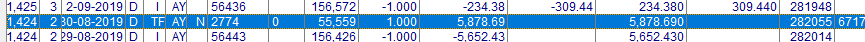

Check the Transactions written

Now look at this Item in inventory, and check the transaction.

In the GL - AC1320 - Inventory Control Acct

In the GL - AC1330 WIP Control Accoount

The Item has been transferred from WIP to Inventory at the Actual. Cost. That is Actual Material, Actual Labour and Actual Machine. The Estimates have been ignored.

No offsets have also been written as they are not required.

| Transferred from WIP | ($5878.69) |

| Transferred into WIP | |

| $2786.59 |

| $1092.10 |

| $2000.00 |

| $0 |

| $0 |

| Total transferred into WIP | $5878.69 |

| Imbalance | $0.00 |

|---|

Analysis Available

- The Works Order contains both the Estimate and the Actual Values for Material, Labour and Machines.

- Invoice Cost on the Sales Order will be as per Work Order Actual costs.

Advantage / Disadvantage

- Invoice cost is at WO actual cost

- WIP control account is balanced.

- Offset accounts are not used.

- Time Sheet entry MUST occur before WIP Stocking, else the labour will not be accrued & will end up in a COS account un-allocated.

- Machine Entry MUST occur before WIP Stocking, else the cost will be incorrect and the Machine costs will end up in a COS account un-allocated.

- Anaylsis is available both at the Works Order level and at the branch level via the Sales GP reporting.

- Most Complex as it requires a disciplined approach to WIP Stocking, ie Time Sheets and Machine Costs MUST be in first.

- Upside is that it is also the most accurate method presented.

Appendix

What happens if we add a Time-sheet AFTER the Works Order has been Stocked (finalised)

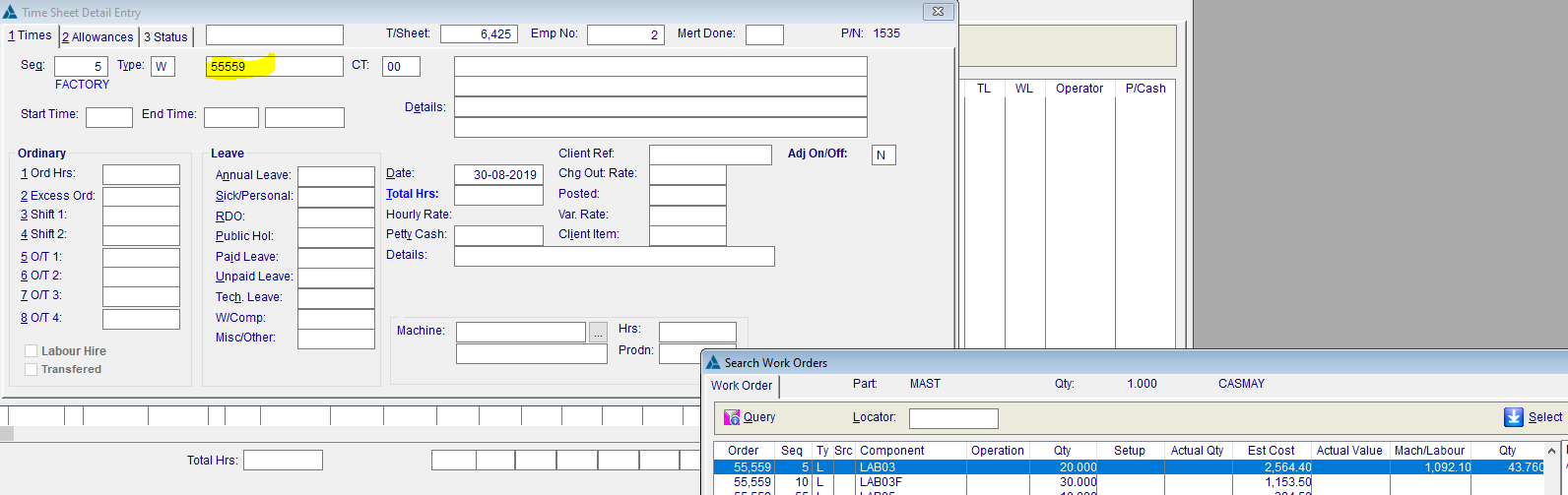

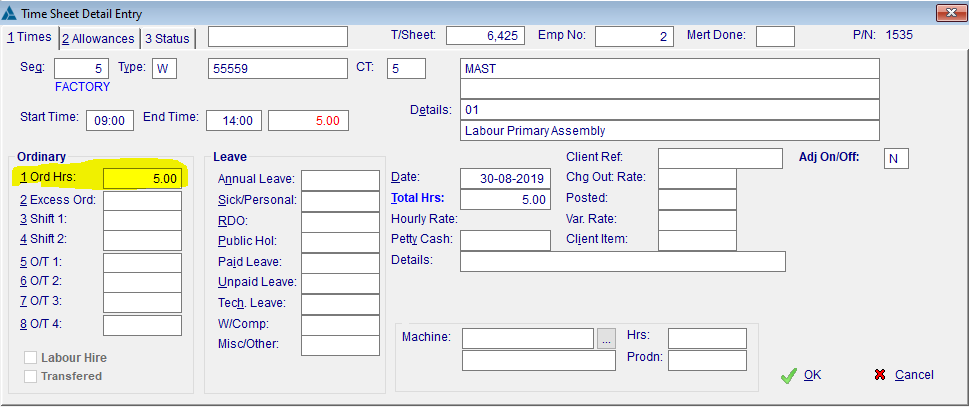

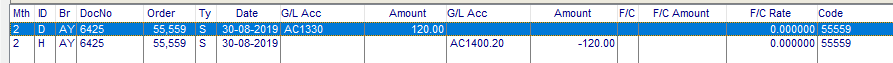

We enter a late timesheet against the WO 55559.

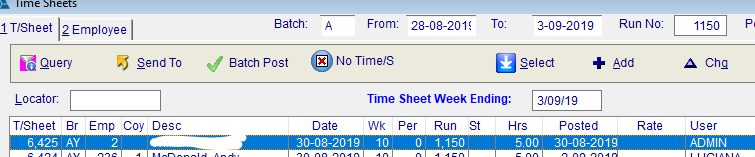

The Timesheet is Posted as normal.

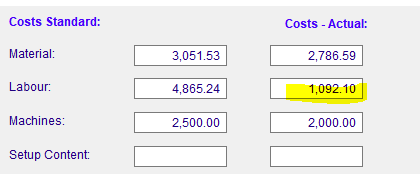

The cost on the Works Order is updated to reflect the extra labour.

| Before | |

| After |

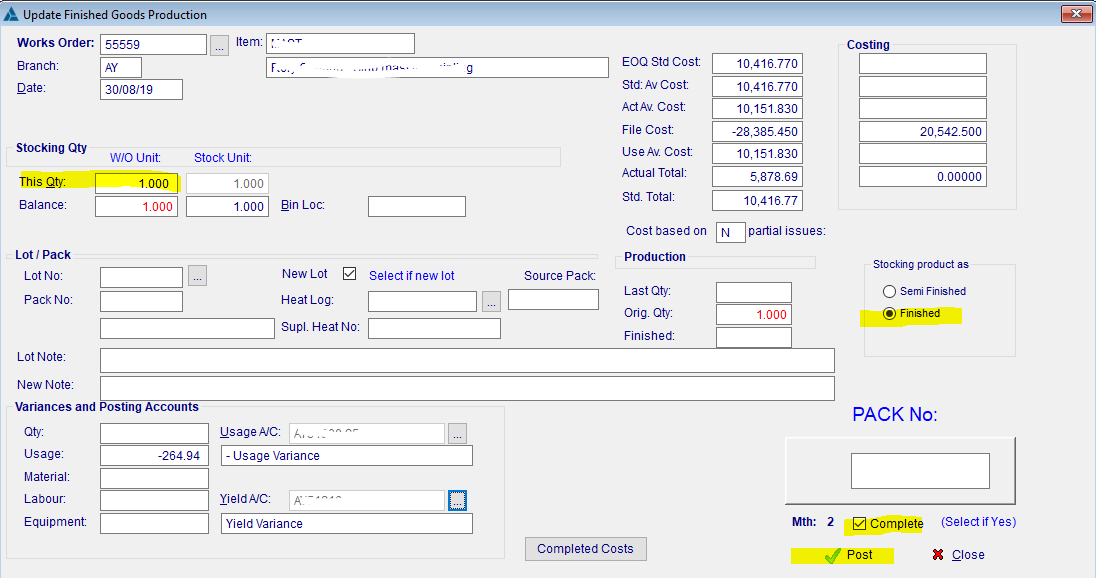

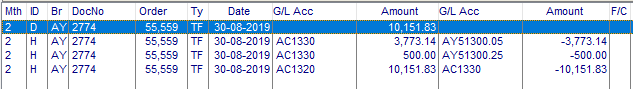

Check the Transactions written

In the GL - AC1320 - Inventory Control Acct

There is NO 2nd entry, Inventory has not been affected.

In the GL - AC1330 WIP Control Account

We see the late time-sheet, Debting AC1330 (WIP) and Crediting AC1400.20 (WIP Time Sheet costing)

So, what just happened.

- By entering a Timesheet against a finalised Works Order we have taken the WIP control account (AC1330) out of balance, by the value of the extra time-sheet.

- The Works Order costing was updated to reflect the additional labour.

- The Inventory was NOT changed, which means that the GP shown in a Invoice GP report will be out by the value of the extra labour.

Copyright Programmed Network Management PL 2023