Single Touch Payroll (STP) changes how you report your employees' end of financial year (EOFY) information to your employees and the ATO.

What you need to know

...

What you need to do

You need to tell your employees:

› you will not be providing them with a payment summary

› their payment summary information will be called an income statement in ATO online in myGov

› they will need to log into their myGov account, select ATO online services, click on my profile, select my employment and then income statement to access this information

› if they use a registered agent to lodge their income tax return, their agent will receive their income statement information directly from the ATO

› if they don't have access or cannot create a myGov account and don't use a registered agent they can call us on 13 28 61 and we'll provide this information to them.

If your employees need help creating or logging in to their myGov account and linking to the ATO's online services, they can access helpful information at ato.gov.au/onlineservices

More information

You can find out more information by:

› Viewing our STP end of financial year factsheet at ato.gov.au/STPresources

› Speaking to your registered tax or BAS agent

In Minder Payroll

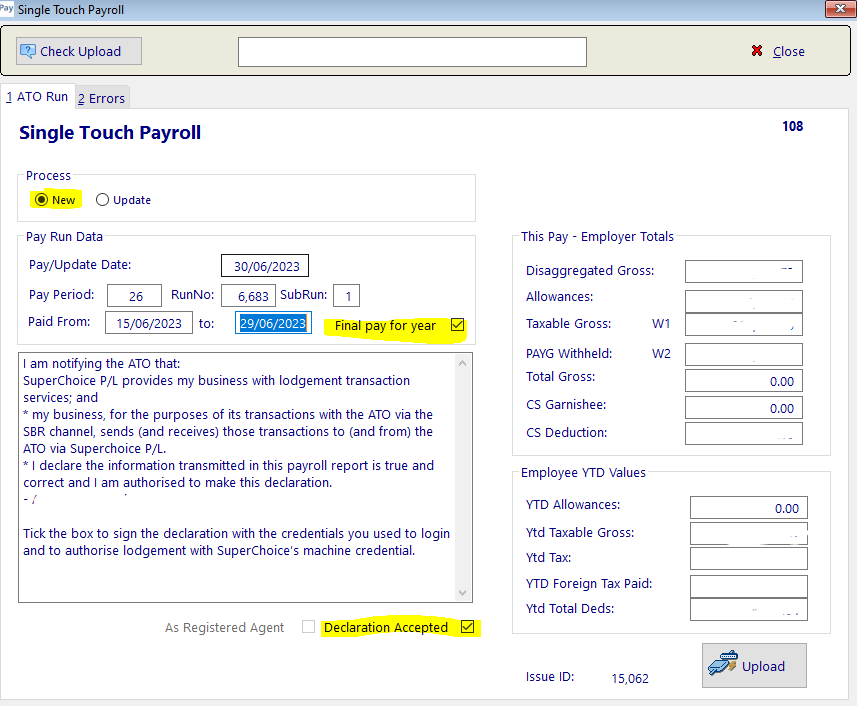

- The ATO requires you to declare the final pay of the Payroll Year.

- This signals that the employee now can complete their tax return for the year.

- The Payroll year IS NOT your accounting system Financial Year, they may or may not align.

...

Payroll Year

The Payroll year is when you PAY your employees, ie normally the date you upload the EFT file to the bank.

Example:-

- Payrun ends 27th June,

- Employee's are Paid 30th June.

- This is the Final Pay for the year.

- Employee's are Paid 30th June.

- Payrun ends 28th June,

- Employee's are Paid 1st July,

- this is the FIRST pay of the NEXT year, the final pay was the previous PayRun.

- Employee's are Paid 1st July,

...

- Process the pays as normal

- When you get to the STP step, you TICK the check box for 'Final Pay'.

- Process the rest of the STP step as normal.

You now need to Close the Pay Year:-

...

Q & A

Q. I've done the last Payrun, but I didn't tick the box when I uploaded the STP. What do I do now?

...