Single Touch Payroll - Final Pay for the Year

- The ATO requires you to declare the final pay of the Payroll Year.

- This signals that the employee now can complete their tax return for the year.

- The Payroll year IS NOT your accounting system Financial Year, they may or may not align.

Payroll Year

The Payroll year is when you PAY your employees, ie normally the date you upload the EFT file to the bank.

Example:-

- Payrun ends 27th June,

- Employee's are Paid 30th June.

- This is the Final Pay for the year.

- Employee's are Paid 30th June.

- Payrun ends 28th June,

- Employee's are Paid 1st July,

- this is the FIRST pay of the NEXT year, the final pay was the previous Payrun.

- Employee's are Paid 1st July,

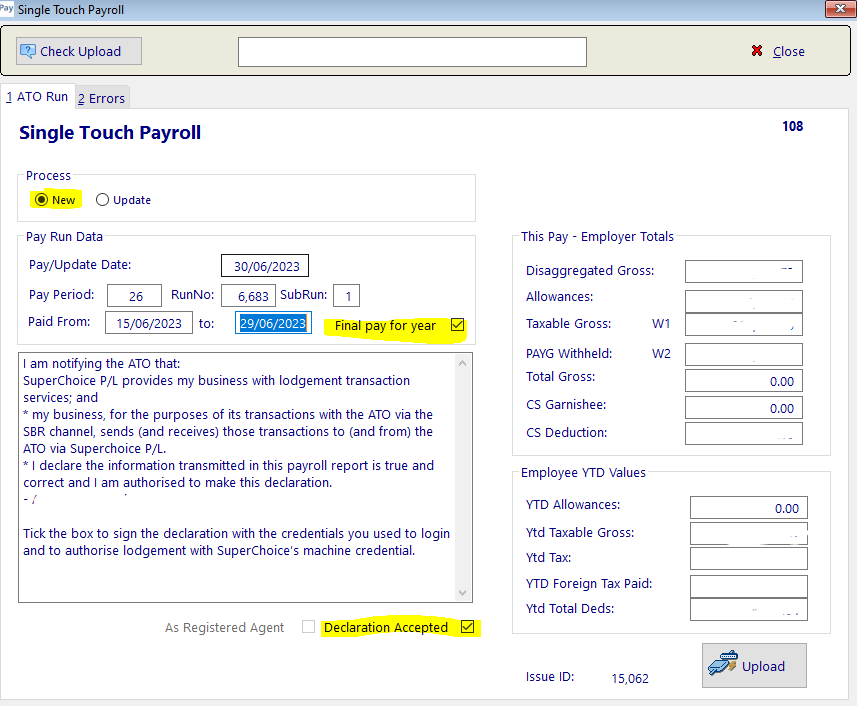

To declare that this is the Final Pay for the Year

- Process the pays as normal

- When you get to the STP step, you TICK the check box for 'Final Pay'.

- Process the rest of the STP step as normal.

Close the Pay Year:-

The Pay Year now needs to be closed.

See:- Close the Pay year

Q & A

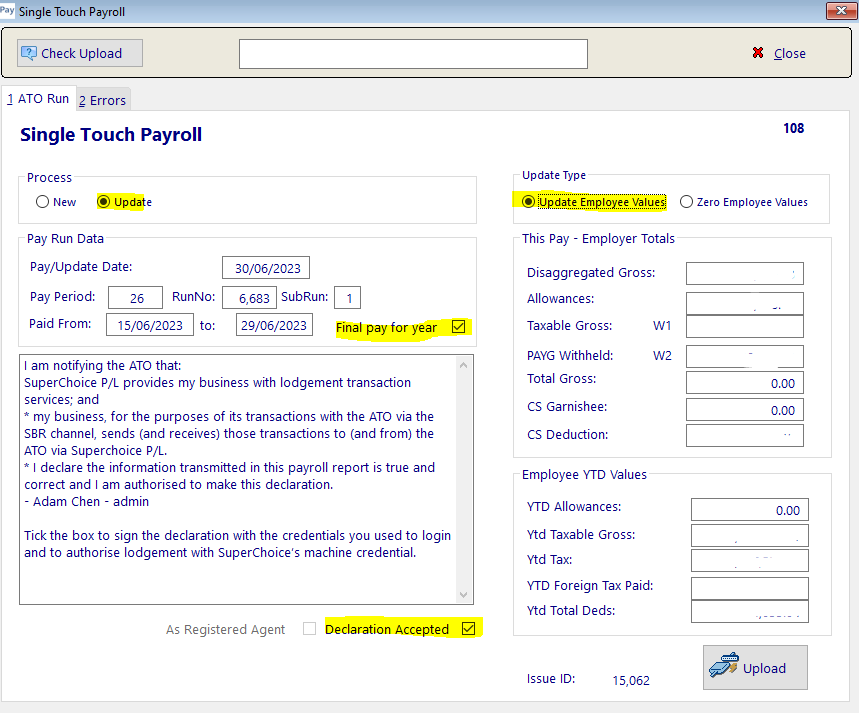

Q. I've done the last Payrun, but I didn't tick the box when I uploaded the STP. What do I do now?

A. Don't panic, provided you haven't Rolled into the Next Payrun, you can simply do the STP upload again, ticking the update box.

If you have rolled the Pay's, contact support.

Copyright Programmed Network Management PL 2023