...

Print the PAYG's (by the 14th July)

- Create a file (EMPDUPE.A01) for the ATO (once a year, by mid-August).

- Load to ATO using the Business portal.

Pre-requisites

Ensure that ALL pays for the year have been Posted to the GL. ie Post & Advance Pays.

This is when they are added to YTD figures, used by PAYG Print.

Check that the static employer data has been entered in the Pay system file.

You can press the Test Data button for Co & Employee data to be tested.

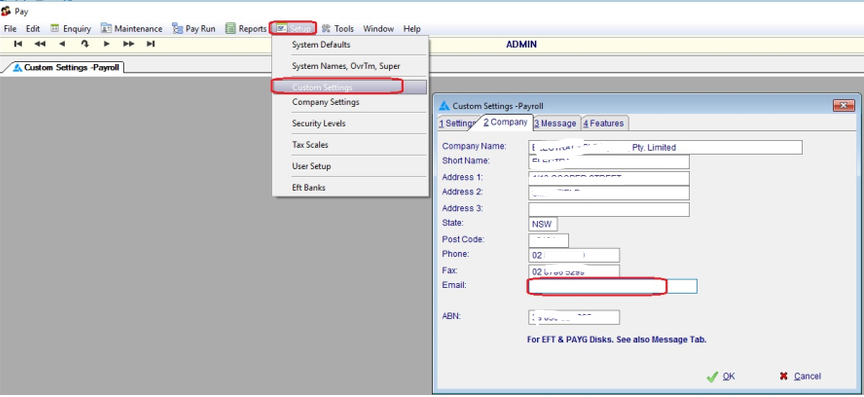

Pay system data is located from the Menu in Setup, Custom Settings.

Enter the company data and ABN in the Company Tab and the signatory and contact in the Message tab as illustrated in the following two screens:

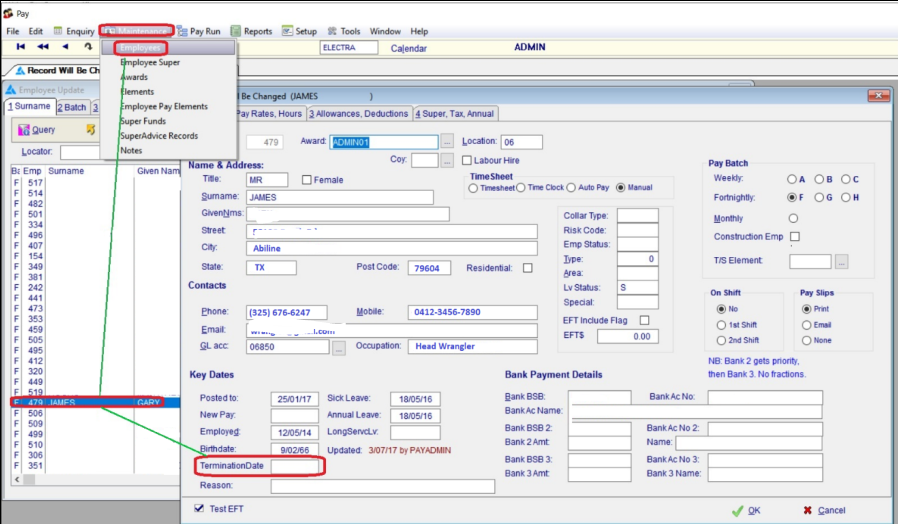

PAYG's may be printed during the year if required. During the employee's last pay run make sure the Termination Date (Tab 1) is entered to ensure the tax calculations are correct. The pay should then be posted in the normal manner so that the year-to-date totals are updated. The following screen is Tab 1 of the manual pay run screen.

...