Payroll EOFY Procedure

Precis

This procedure will be obsolete in FY 18/19 due to the introduction of Single Touch Payroll which negates the need for PAYG Payment Summaries.

The Group Certificate, now called PAYG Payment Summary (PAYG) is on plain paper and the format has been approved by the ATO.

Print the PAYG's (by the 14th July)

- Create a file (EMPDUPE.A01) for the ATO (once a year, by mid-August).

- Load to ATO using the Business portal.

Pre-requisites

Ensure that ALL pays for the year have been Posted to the GL. ie Post & Advance Pays.

This is when they are added to YTD figures, used by PAYG Print.

Check that the static employer data has been entered in the Pay system file.

You can press the Test Data button for Co & Employee data to be tested.

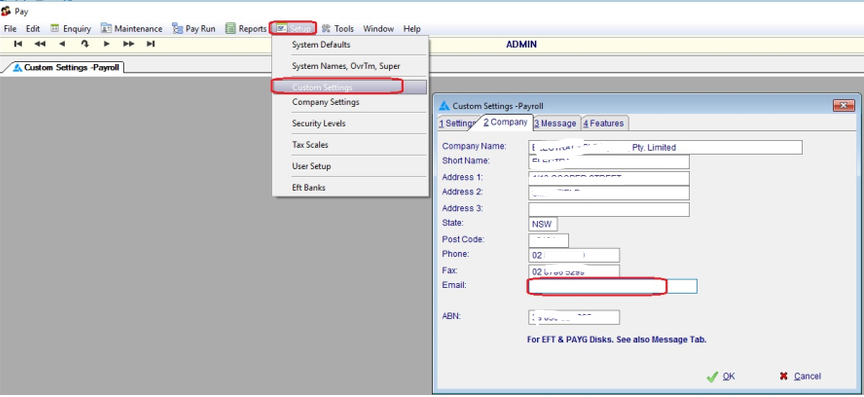

Pay system data is located from the Menu in Setup, Custom Settings.

Enter the company data and ABN in the Company Tab and the signatory and contact in the Message tab as illustrated in the following two screens:

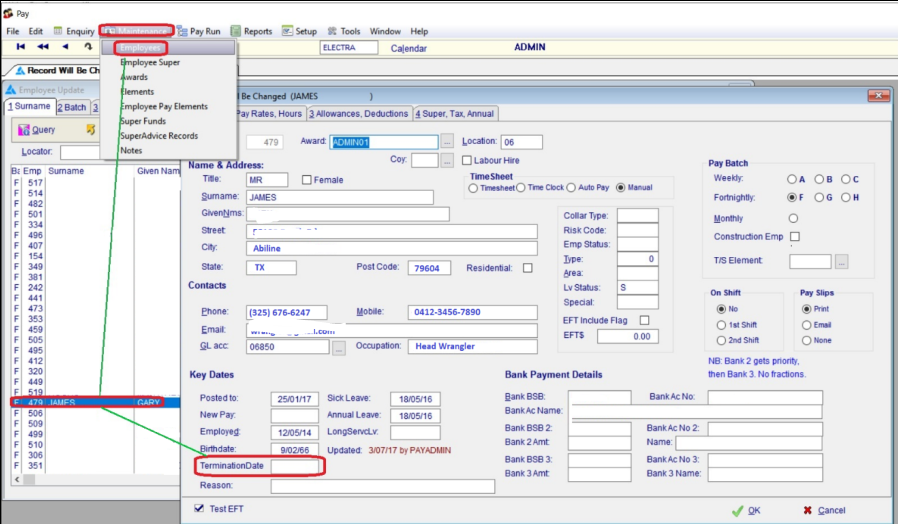

PAYG's may be printed during the year if required. During the employee's last pay run make sure the Termination Date (Tab 1) is entered to ensure the tax calculations are correct. The pay should then be posted in the normal manner so that the year-to-date totals are updated. The following screen is Tab 1 of the manual pay run screen.

Printing PAYG's

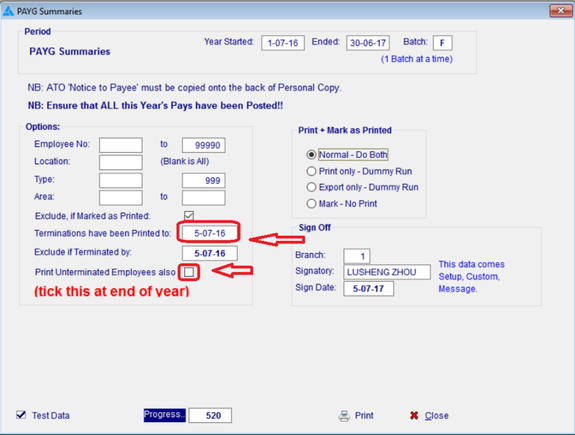

PAYG's are printed one Batch at a time. If there is only one Batch used, eg; A for Weekly, then only one print run is required and the system will already be set to that batch.

The runtime report options cater for

1: printing and updating the employee file as printed

2: printing as a 'dummy' run and not updating the employee as printed

3: not printing and marking the employee as printed

The following screen illustrates the PAYG print options. Note how the system keeps track of the last date of a termination PAYG run. It also has a tick box that excludes those already printed. These fields may be changed if you need to reprint a previous PAYG.

The system defaults the PAYG print options to only do those who have terminated. At year end the Print Unterminated Employees check box needs to be clicked.

Reconciling

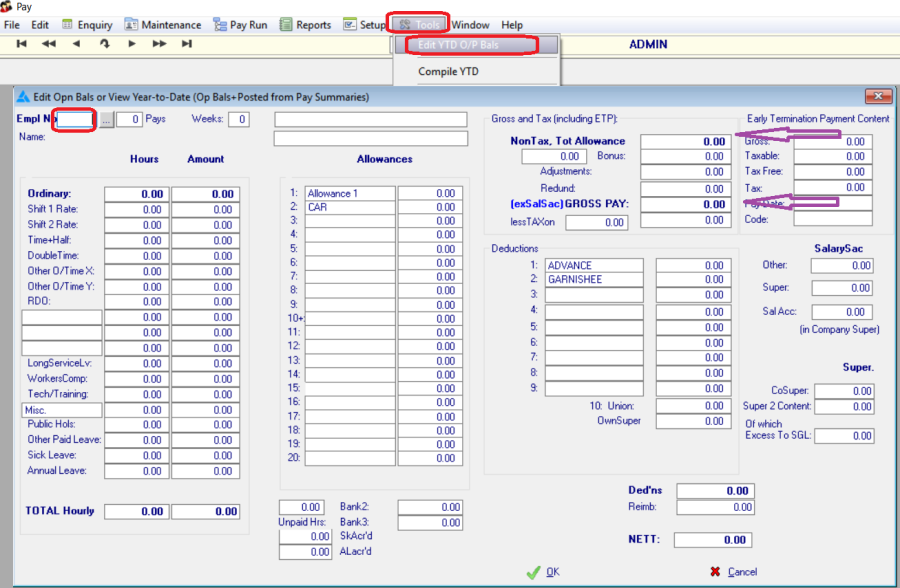

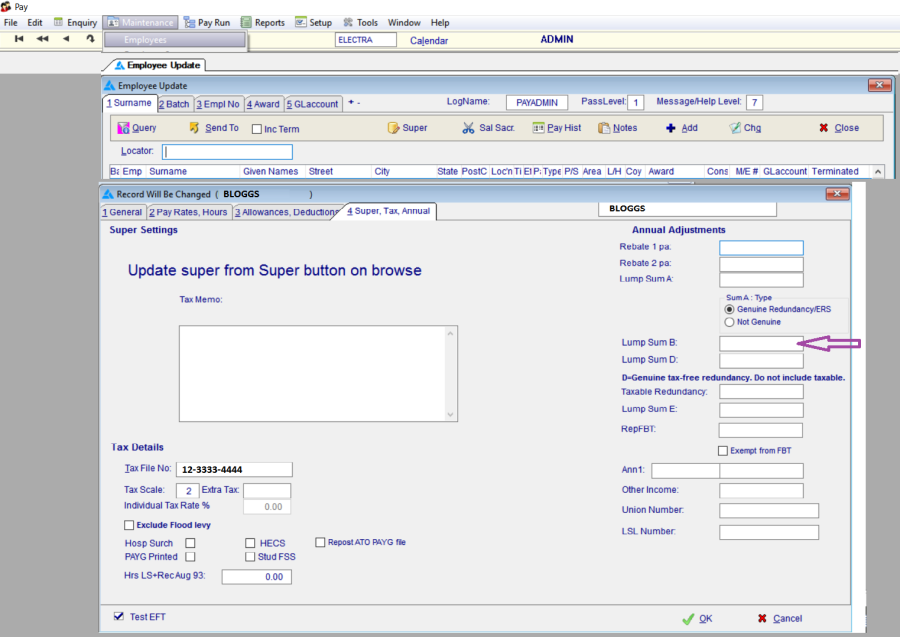

When reconciling the PAYG with YTD (In Enquiry, Employee, YTD), note that the ATO requires the GROSS PAYMENTS that prints on the PAYG to be adjusted to exclude anything that prints separately, ie; Lump Sums, Untaxed Allowances, CDEP, Other Income, FBT etc.

It will not be the same as the Employee's YTD Gross in YTD Enquiry screen.

Look in Setup, System Names to see which Allowances are Taxable. Only the NoTax Allowances are taken off the Gross and printed separately.

Empdupe.A01 file

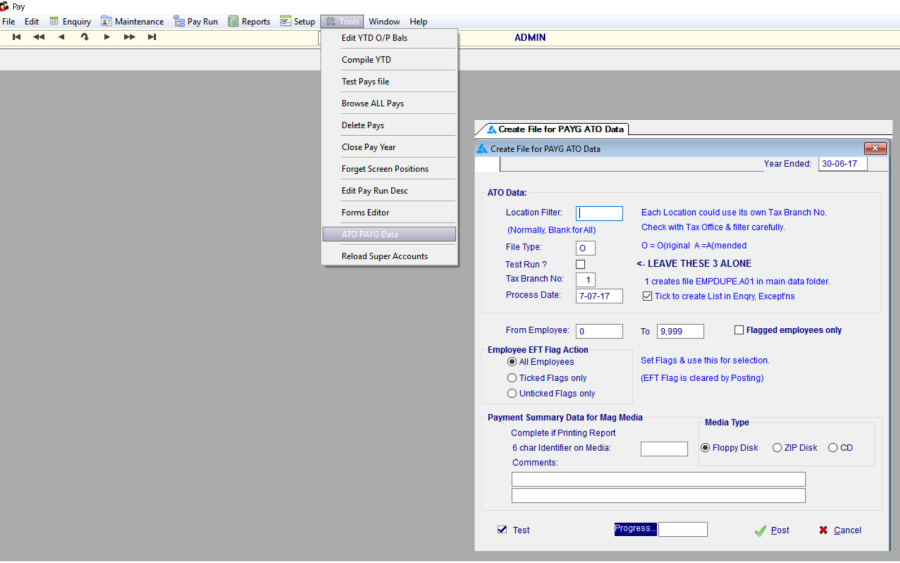

The step by step procedure is as follows

- In Windows explorer, navigate to C:\MBS\XTRA and delete or rename any existing EMPDUPE.A01 file.

- Check that all pays have been run and posted and that all PAYG's have been printed.

- Go to TOOLS and select the DUMP PAYG Data. If there are any errors in the employer data they will be reported to the screen. These need to be fixed as described in Prerequisites.

- Go to Enquiry, Exceptions, and check for any employee errors.

- Unless you have multiple Tax Branches, leave Location blank and leave Tax Branch as 1.

- Once all clear, select POST. This will create a file EMPDUPE.A01 in the main data directory eg C:\MBS\XTRA (where XTRA represents what your company's abbreviation is).

- You should then use Windows Explorer to copy this file to a USB Key / CD or convenient location for upload via the ATO Business Portal.

- Keep a backup of this file, and preferably your whole data folder, before doing End-of-Year (once closed, YTD Data is then hard to recover).

- If you are sending a test file to ATO, check Test Run when creating it.

- If you are sending a USB key must be accompanied by a Magnetic Media Information Form and labeled as EMPDUPE.A01, have a 6 character identifier on it (same as on the Form). For an upload via the ATO Business Portal, this form is not required & can be discarded.

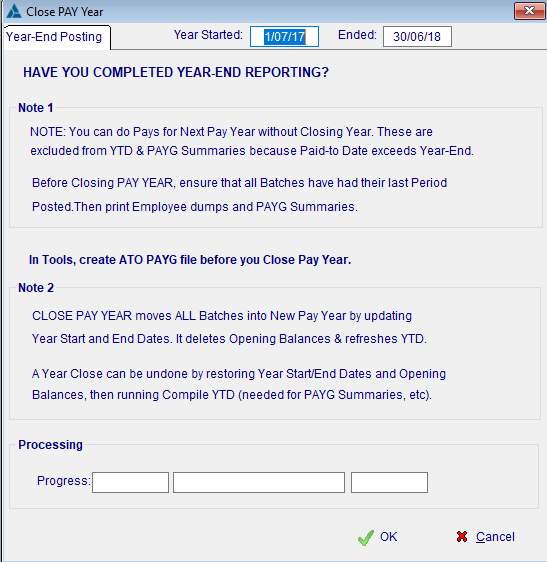

Close the Pay Year

Once you have uploaded the file (or sent the USB stick to the ATO), you can close the pay year.

This should only be done once you have received a successful result from the ATO on the upload. DO NOT CLOSE before hand. If there is something amiss with the file & it needs to be recreated, it can not be done if the year is already closed.

- Pay

- Tools

- Close Pay Year

- Click OK

- Tools

Copyright Programmed Network Management PL 2023