Procedural Changes due to STP

Preci

Single Touch Payroll is a government initiative to streamline business reporting obligations.

Employers will be able to report salary or wages, pay as you go (PAYG) withholding and super information to the ATO from their payroll solution, at the same time they pay their employees. There will also be more options for completing tax and super forms online. STP has begun for employers with 20 or more employees (1 July 2018 being the mandated date). It will be expanded to include employers with 19 or less employees from 1 July 2019, subject to legislation being passed in parliament (has been passed).

This means that reporting by Single Touch Payroll is no longer an option and penalties will start to be applied in the next financial year. (On ya ATO!)

So What's changed in Minder

On the surface, not much. Underneath, well just think of the duck. Most of the changes for the payroll person are actually procedural and this is what we are addressing in this document. Conservatively we have pumped 8 months into this project, with more too come.

Not yet implemented, but required by the ATO going forward is Multi-factor Authentication. Essentially this means you won't be able to access sensitive personal employee data, such as Tax File Numbers, Birth Dates and addresses unless you key in a code which will be sent to your mobile.

We also want to improve the interface to the Superannuation Clearing House, currently it's a big clumsy & could be made better.

Cut to the Chase - What's the biggest thing!

- You MUST complete the payroll, Roll the Pay Period and upload the file on or before pay day. This is a legislative requirement.

- Repeat, you cannot leave a pay period open.

- There is no end of year Reconciliation, you must do it as you go.

- No more Group Certificates, your employees will need a MyGov account if they want to see their details, or just rock up to their local tax agent.

What are you sending to the ATO?

Employer

- Pay Period Gross Wages, including allowances.

- Pay Period Gross Tax.

- A Declaration that the figures are correct.

- Identifying information such as your ABN number, address, etc

This will pre populate W1 and W2 on your BAS statement.

Employee

- Year To Date Gross Wages.

- Year To Date Allowances (if any).

- Year To Date Tax.

- Year to Date Super.

- Identifying information, including TFN, DOB, current address.

Again, this is used to populate their tax returns.

And this goes Straight to the ATO ?

In an ideal world, yes. But this is the ATO we are talking about, so no, it doesn't. In order to hook up directly to the ATO they imposed some security requirements. These security requirements are so tough almost no Payroll provider was able to write a 'connector' to get the job done. Faced with this dilemma, rather than relaxing the requirements, or writing and giving software developers the connector, the ATO decided to implement 'Sending Service Providers', or SSP's.

So it works like this. The SSP has the connector to the ATO, we, as in Minder and almost all other Payroll software companies, then connect to the SSP, who transmit the information on you behalf. That fixed the security problem didn't it! So we now have a situation where a commercial third party has to sit between your payroll and the ATO. The ATO says this protects 'their' network, but it's you that are having to pay for it.

Which brings us to SuperChoice. Early on, once we flagged with the ATO that this whole security thing sucked big time, we started to cast around for a third party SSP we could work with. There aren't many, but the SuperChoice guy's are really good at what they do and provide a number of benefits that the others didn't. Primarily is the 'Validation' of the file before it gets to the ATO. This validation is fantastic as it picks up 98% of all problems before they become a major headache. Remember, once the ATO have the file it is very difficult to correct mistakes, so by Validating the file first we can be fairly sure that it is acceptable to the ATO.

Your company will have an account with SuperChoice, we will set that up when we implement STP with you. You may request a log in to that account should you want one.

But they charge!

Sorry about that, blame the ATO. You will see a line item on your software maintenance invoice which is to cover the fee's. Honestly it is not a lot of money and represents good value.

The Actual Process

See your Support contact for Important Setup information.

2 Factor Authentication.

Note that the ATO requires that all access to a Payroll system is logged and prtected by 2 Factor Authentication. See this document for further details.

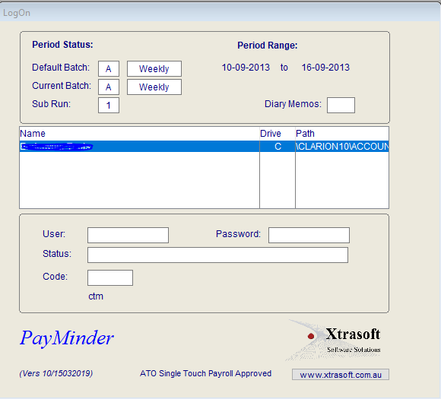

Assuming your are already logged into the Payroll System:-

1.Process the Payroll as normal

be it direct entry, via time sheets, or a combination. Arrive at the point where you are ready to get approval.

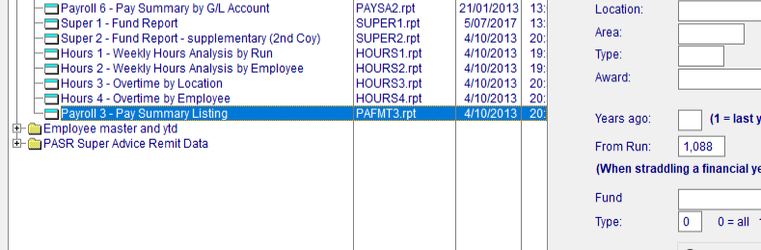

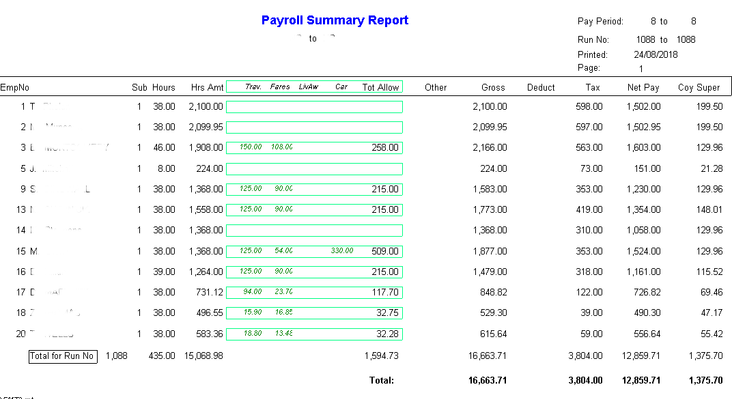

2 .Print the 'Approval' Report,

Normally this will be 'Payroll 3 - Pay Summary Listing'.

- Payroll

- Reports

- Report Manager - Reports

- Payroll 3 - Pay Summary Listing

- Report Manager - Reports

- Reports

3. Gain approval as per your Company's Standard Operating Procedures.

Once you have sign off, you can proceed with the payroll.

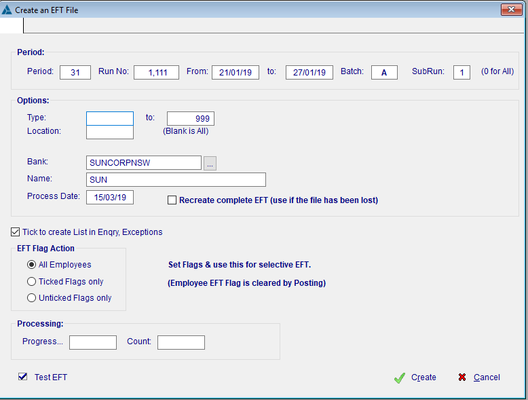

4. Produce ABA file for bank & upload. - as per normal procedure

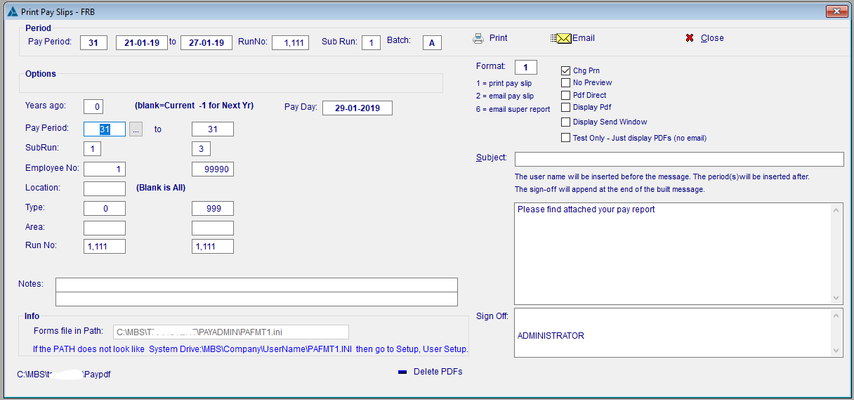

5. Print / Email Payslips - as per normal procedure

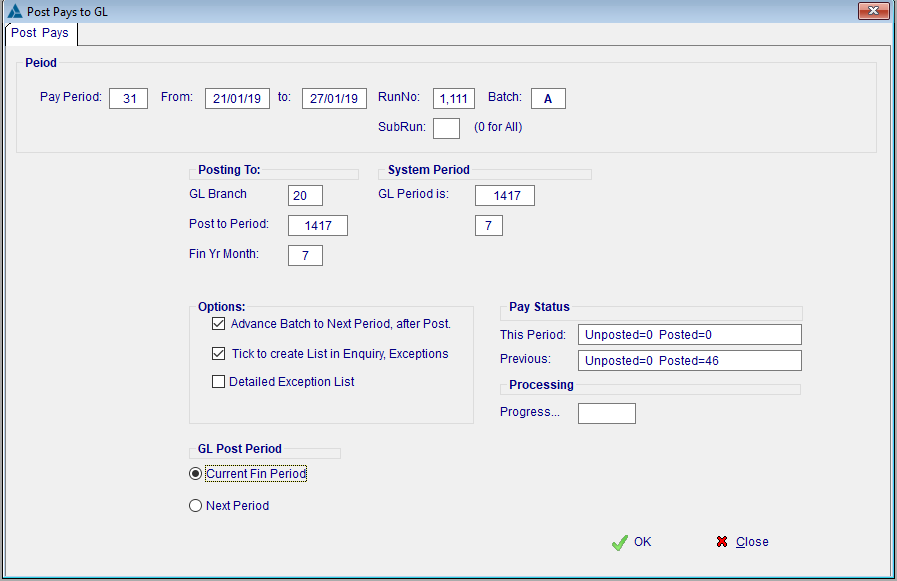

6 .Close the Pay Period.

You will have done this before, but now you cannot leave it open, it must be closed prior to processing Single Touch Payroll.

- Select 'Post+Advance Pays'

7 Single Touch Reporting

Once the Payslips are run, the ABA file has been uploaded to the bank & the Pay Period is closed, we can now commence the new part of the process.

- Click on Single Touch Payroll

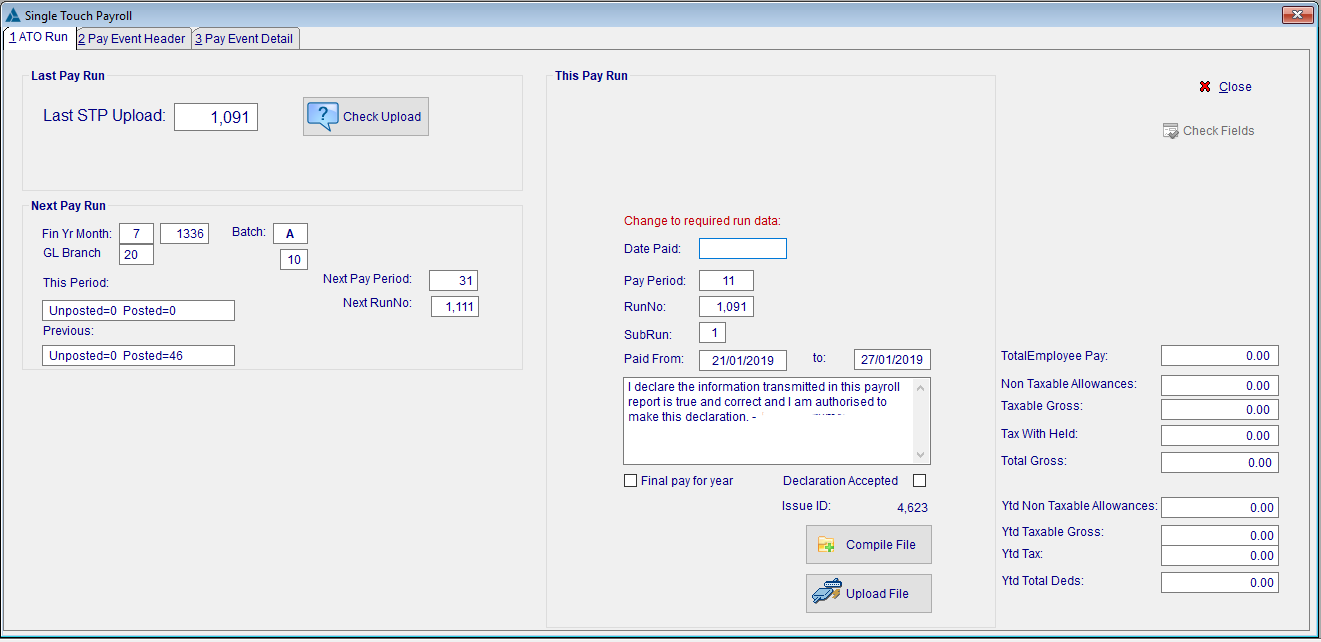

The screen is broken up into 3 sections.

Last Pay Run.

You can Check the status of your last upload here.

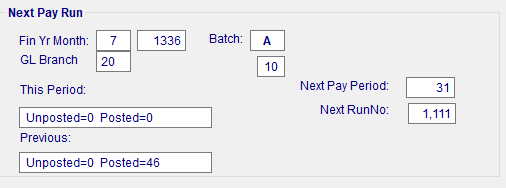

Next Pay Run.

This is a double check that you have CLOSED the Pay Period

It also gives you a clue as to what should be in the following section (ie the Pay Period & Run No should be less 1!)

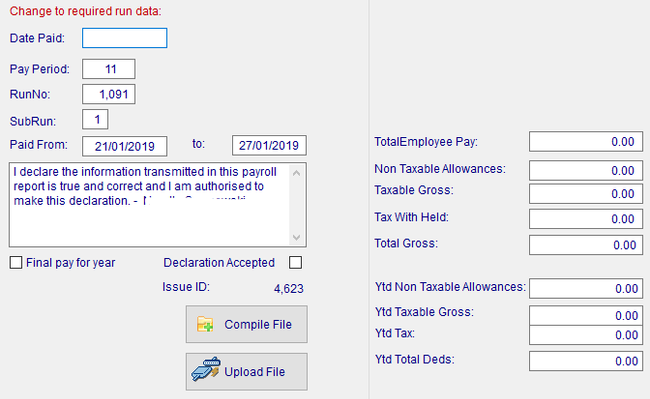

This Pay Run

You must set the following:-

- Date Pays Paid → The date your payroll arrived at the bank.

- Pay Period → The current Pay Period

- From / to → The Pay period from / to Dates

- Declaration Accepted → Tick if you agree with the Declaration

8. Compile the File

Once those fields are OK, you can then press 'Compile File'

This creates the file & produces the actual Payroll report that is sent to the ATO in the next step.

- You will get a 'Processing Complete' box, click 'OK'.

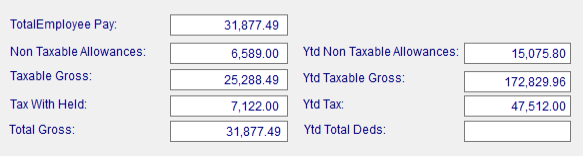

The screen will now display the Totals for:

- The Employer pay period data

- The Employee Year to Date data.

This should equal your previous Payroll Reports.

9 Upload to ATO

Now Click on the 'Upload File' button

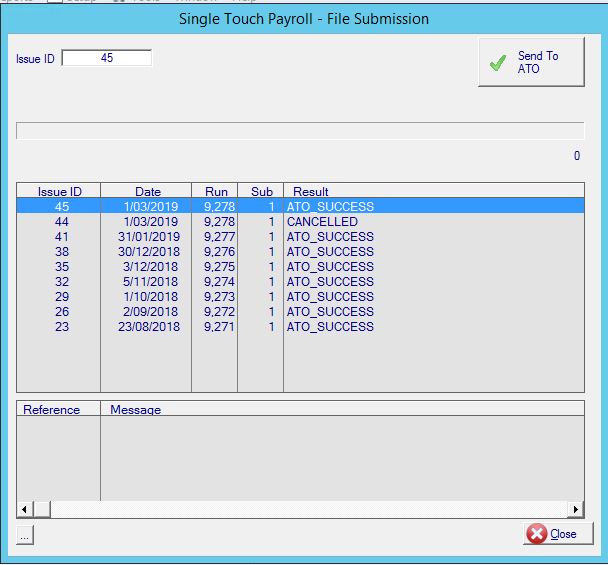

A new screen is displayed

The browse box will display the status of previous submissions.

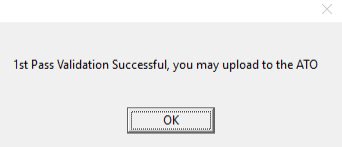

- If all goes well, you will get a successful Validation.

If the Validation is Successful, then the file will be automatically submitted to the ATO.

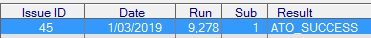

Once this has occurred, you will be able to click on the latest Issue ID and receive the status from the ATO.

The Message you are looking for is 'ATO_SUCCESS'.

10. Procedure Complete

Possible messages are:-

"INVALID_API_REQUEST"

"SUPERCHOICE_SYSTEM_ERROR"

"SUBMISSION_FAILED_VALIDATION"

"PRE_SUBMISSION_PASSED_VALIDATION"

"SUBMISSION_INITIATED"

"SUBMISSION_FAILED_SECONDARY_VALIDATION"

"ATO_RECEIPT"

"ATO_WARNING"

"ATO_PARTIAL_SUCCESS"

"ATO_SUCCESS"

"ATO_ERROR"

"CANCELLED"

Related content

Copyright Programmed Network Management PL 2023