Allowances - STP1 only

Needs Updating for STP2

If there is one thing that will screw up your payroll it will be Allowances. Mis-categorising allowances will cause employee tax assessment and balancing issues.

Different types of allowances are subject to Pay as you go (PAYG) withholding and may / or may not be included in OTE (Ordinary Time Earnings) for the purposes of Superannuation.

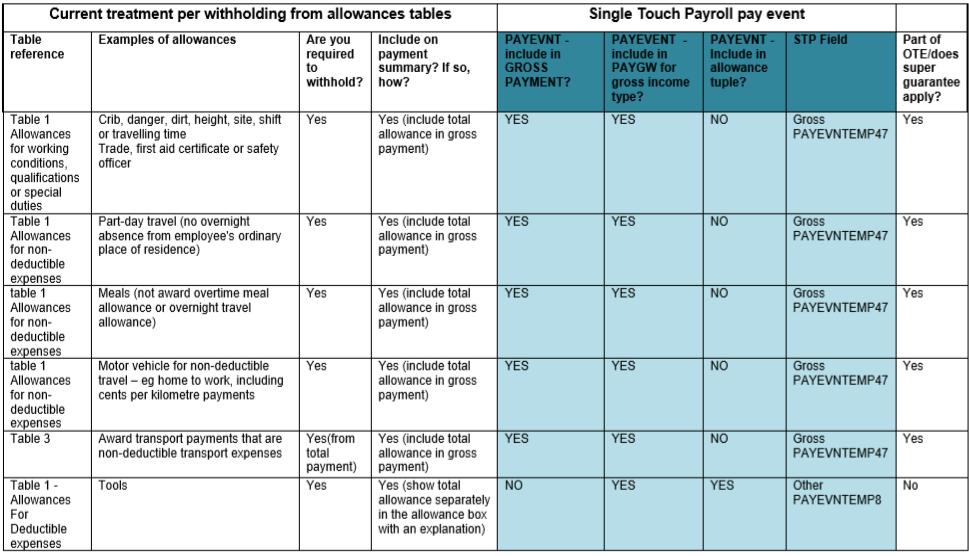

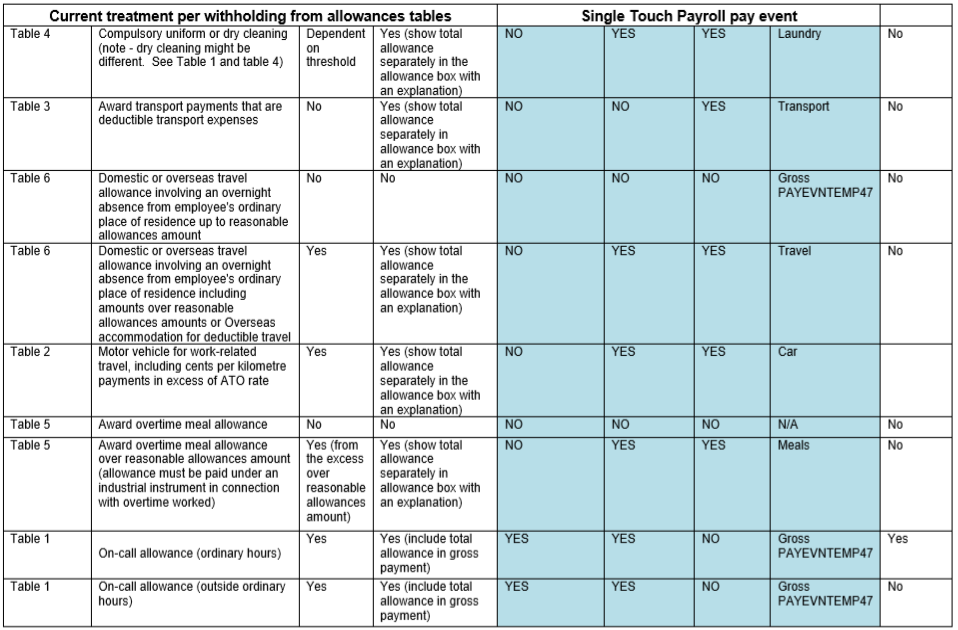

Single Touch Payroll (STP) specifies those allowances requiring separate identification & reporting. Refer to the table at the bottom of this document for details.

Allowance amount

For STP this is the year to date amount for the specific allowance type. Amounts recorded here are not included in Gross payments. Any PAYGW amounts withheld from allowances is to be aggregated into the PAYGW amount recorded against an income type.

Allowances are now reported directly to the ATO via Single Touch Payroll. Whilst their tax treatment hasn't changed, the reporting has, as per the tables below.

Please note the STP ATO Field, this indicates what we need to insert against each allowance in Minder.

If in doubt ASK YOUR ACCOUNTANT, have a look at these two examples!

Example 1

Car (Table 2) - work related travel only

- Are you required to withhold? ie Taxed - YES

- Include in Payment Summary - YES, total shown in separate box.

- STP - Included in Gross Payment (Employer) - NO

- STP - Included in Gross Payment (Employee) - YES

- STP - Included as a separate Allowance item - YES

- STP - What Field - Car

- Does Super apply? - No

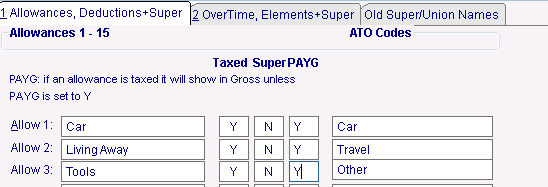

So, Minder will look link this:-

- Payroll

- Setup

- System Names / Overtime / Super

- Setup

- The Car allowance is Taxed (Y), it does not get included in the Super calculations (N), and it appears separately for PAYG (Y), under ATO code 'Car'. It isn't included in their Gross.

- Living Away Allowance is Taxed (Y), isn't used for Super (N) and also appears separately for PAYG purposes (Y), under ATO code 'Travel'. Not included in their Gross.

- Tool Allowance is Taxed (Y), again isn't used for Super (N), appears seperately for PAYG (Y), under ATO Code 'Other". In this case the allowance title (Tools) will also be sent to the ATO. Not included in their Gross.

- Note allowances 1-4 will check if a description is set on the employee master record.

Example 2

Car (Table 1) - includes non-work related travel

- Are you required to withhold? ie Taxed - YES

- Include in Payment Summary - YES

- STP - Included in Gross Payment (Employer) - YES

- STP - Included in Gross Payment (Employee) - YES

- STP - Included as a separate Allowance item - NO

- STP - What Field - N/A

- Does Super apply? - YES

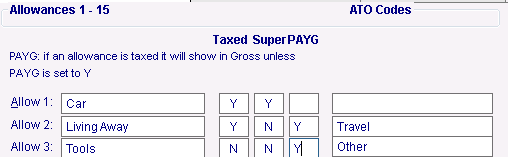

Now the allowances in Minder look like:-

So in this case, the 'Car Allowance' is not an allowance at all, it is just part of their Gross Salary.

ATO Allowances Table

Related content

Copyright Programmed Network Management PL 2023