Taxable payments annual report

You may need to lodge a Taxable payments annual report by 28 August each year if you are a:

- business in the building and construction industry

- government entity.

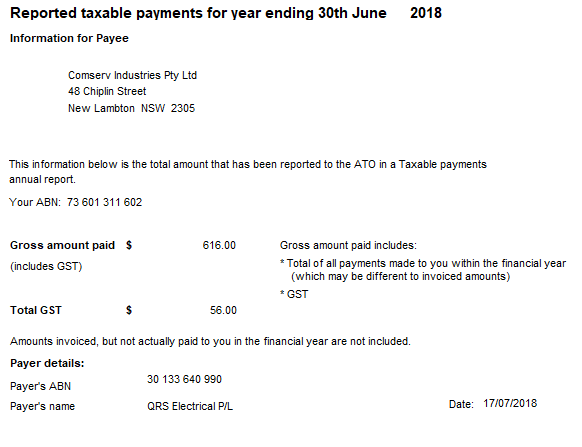

The Taxable payments annual report tells the ATO about payments you have made to contractors for providing services.

Contractors can include subcontractors, consultants and independent contractors. They can be operating as sole traders (individuals), companies, partnerships or trusts.

The details you need to report about each contractor are generally found on the invoice you should have received from them. This includes:

- their Australian business number (ABN), where known

- their name and address

- gross amount you paid to them for the financial year (including any GST).

The ATO uses this information to identify contractors who haven't met their tax obligations.

Further information:- https://www.ato.gov.au/Business/Reports-and-returns/Taxable-payments-annual-report/

To Create the file (TPAR)

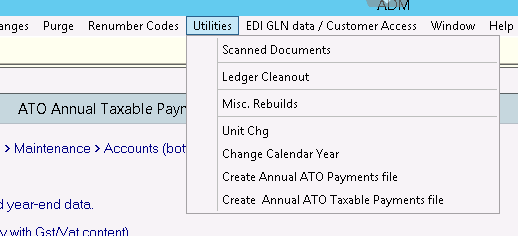

- admin

- Utilities

- Create ANNual ATO Taxable Payments file

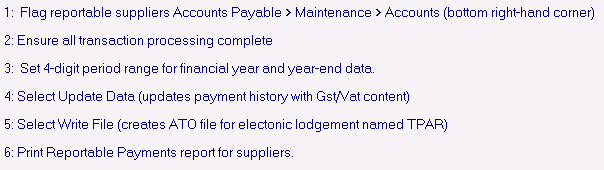

Follow the instructions:-

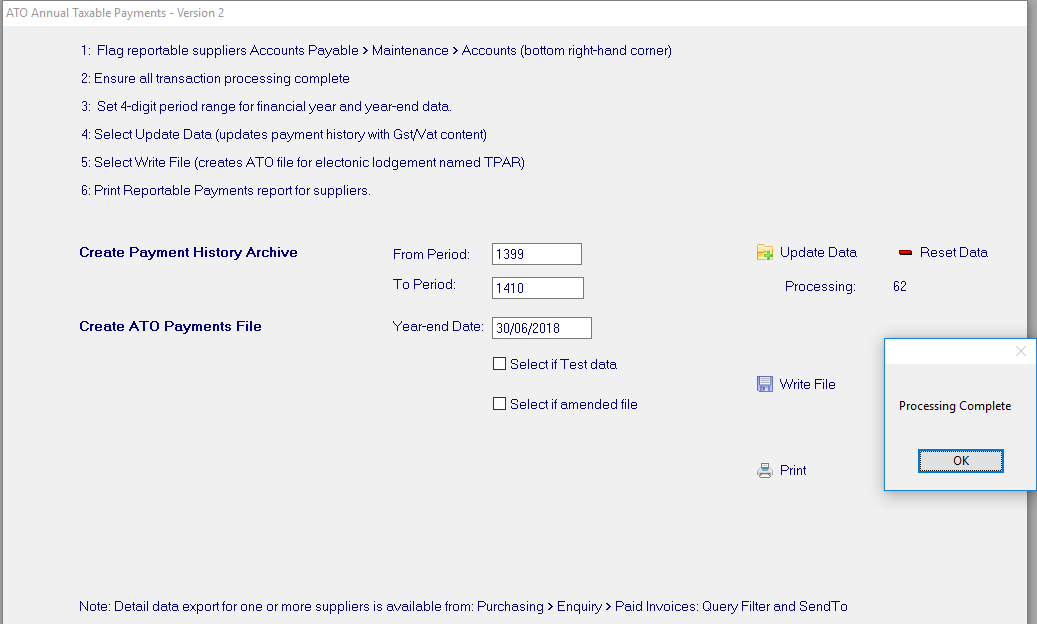

Update the Data

- The period range for 2018 would be 1399 – 1410 (Jul17-Jun18)

- Year to Date (in this case) would be 30/6/18

- Click Update Data

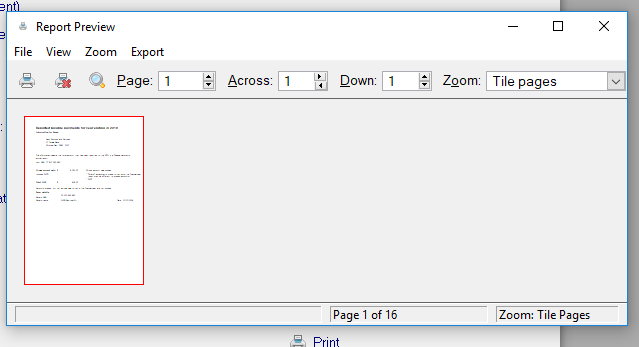

Print the Reports

Click Print (do the print first)

These reports need to be posted to the creditor.

Create the TPAR file

- Now we need to create the file.

- Click Write File

This is the file that needs to be sent to the ATO

Close out of the Admin Menu.

Upload the File to the ATO

Navigate to where your MBS files are located, the file will be in the root directory of the company.

Copy this file the where you need too so that you can upload to the ATO with your an AUSkey or your myGov login. Normally this would be https://bp.ato.gov.au

Procedure Completed

Related articles

Related content

Copyright Programmed Network Management PL 2023