...

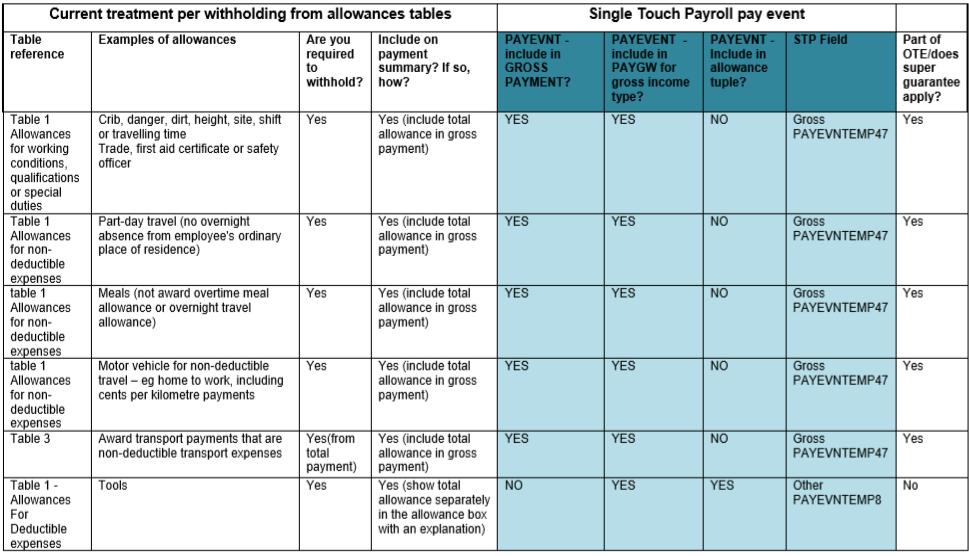

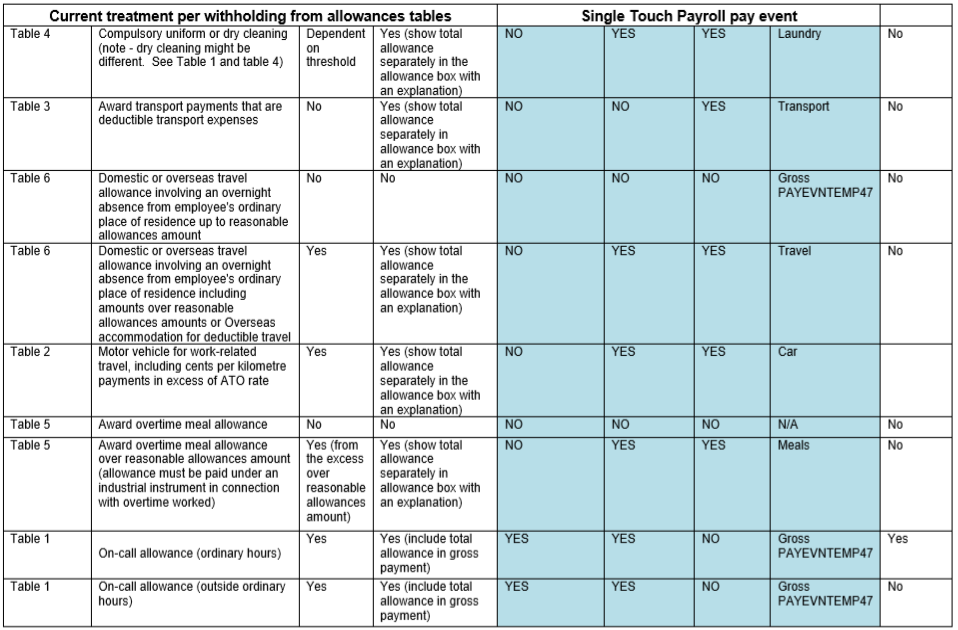

Single Touch Payroll (STP) specifies those allowances requiring separate identification & reporting. Refer to the table at the bottom of this document for details.

Allowance amount

For STP this is the year to date amount for the specific allowance type. Amounts recorded here are not included in Gross payments. Any PAYGW amounts withheld from allowances is to be aggregated into the PAYGW amount recorded against an income type.

...

If in doubt ASK YOUR ACCOUNTANT, have a look at these two examples!

...

Example 1

Car (Table 2) - work related travel only

...

- The Car allowance is Taxed (Y), it does not get included in the Super calculations (N), and it appears separately for PAYG (Y), under ATO code 'Car'. It isn't included in their Gross.

- Living Away Allowance is Taxed (Y), isn't used for Super (N) and also appears separately for PAYG purposes (Y), under ATO code 'Travel'. Not included in their Gross.

- Tool Allowance is Taxed (Y), again isn't used for Super (N), appears seperately for PAYG (Y), under ATO Code 'Other". In this case the allowance title (Tools) will also be sent to the ATO. Not included in their Gross.

- Note allowances 1-4 will check if a description is set on the employee master record.

...

Example 2

Car (Table 1) - includes non-work related travel

...

So in this case, the 'Car Allowance' is not an allowance at all, it is just part of their Gross Salary.

...

ATO Allowances Table

...