- Sales

- Receipts & Journals

- Job Receipt

- Select your victim

- Enter the Retention First

- Select the invoice being paid.

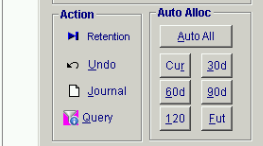

- click on Retention (under Action)

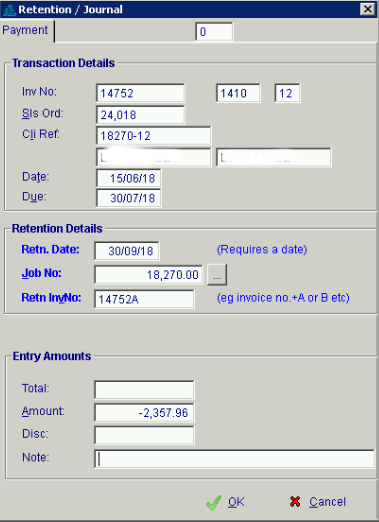

- The Retention Date will normally be 12 months from today.

- The Retention Invoice No is normally the original Invoice number with an 'A' or 'B' added to the end.

- The value of the Retention goes against 'Amount' and is a Negative.

- Click OK, the entry will be made.

- Continue on and allocate any payments against the remaining invoices.

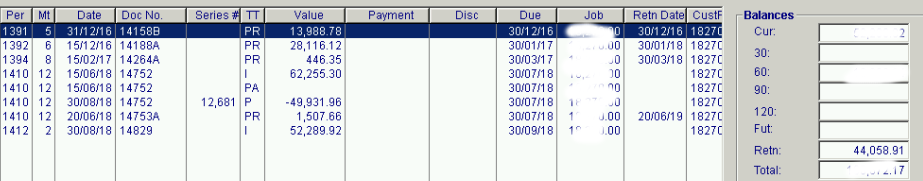

Here you can see the Retention entries (PR) and a date in the Retn. Date Column.