GST in Australia is normally charge against every invoice (there are some exemptions for fresh food items, exports etc).

To review what GST has been 'Charged' (Purchases) and what has been 'Collected' (Sales) you can print the following reports:-

GST on Sales.

- Main Menu

- Reports

- Tranactions

- Transactions

- Tranactions

- Reports

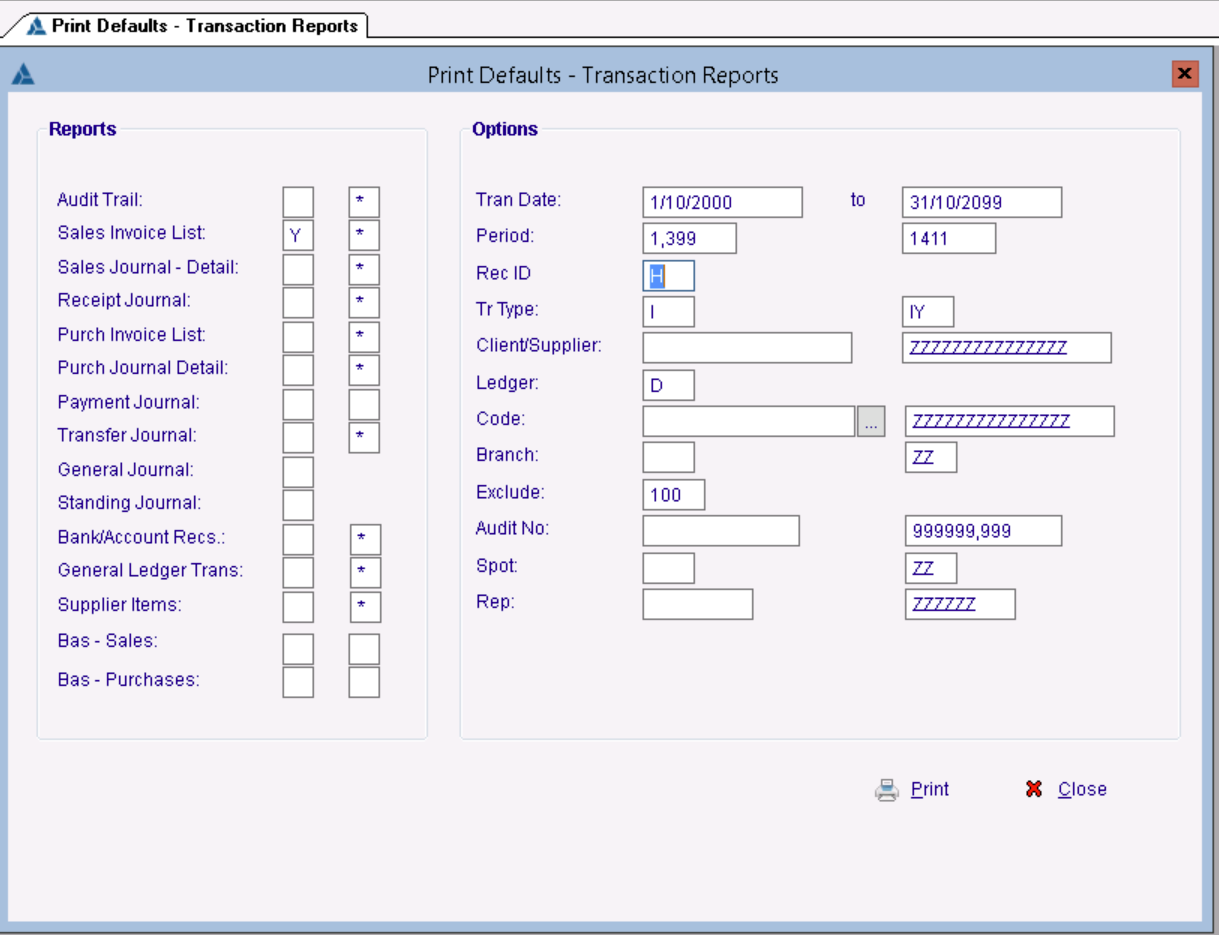

This brings up the Generic Transactions Print Selection Screen.

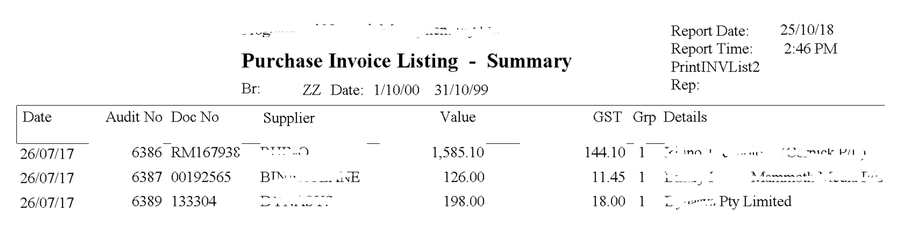

- Click on Sales Invoice List, we are going to print a list of all the invoices.

- Change the Period to (in this case) 1399 (July17) and 1411 (June18).

- If you were doing the quarterly BAS, then you would just have the previous 3 periods.

- Click Print

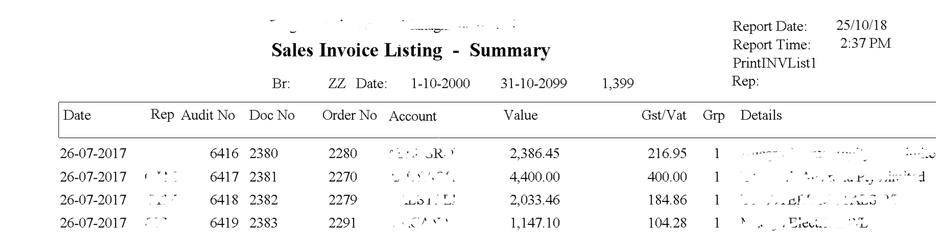

- you can either print the complete report, or just go to the last page (total number of pages is displayed at the bottom right) to get the totals.

For GST on Purchases, the procedure is the same:-

- Main Menu

- Reports

- Transactions

- Transactions

- Transactions

- Reports

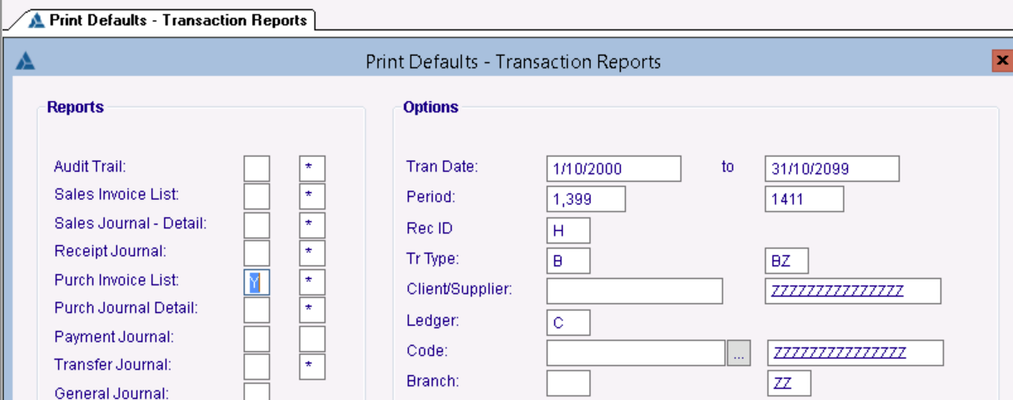

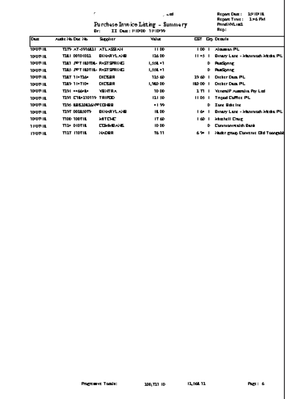

This time we are printing the Purchase Invoice List

- Click Print

\

Once again, you can jump to the final page to get the totals.