...

- You MUST complete the payroll, Roll the Pay Period and upload the file on or before pay day. This is a legislative requirement.

- Repeat, you cannot leave a pay period open.

- There is no end of year Reconciliation, you must do it as you go.

- No more Group Certificates, your employees will need a MyGov account if they want to see their details, or just rock up to their local tax agent.

What are you sending to the ATO?

Employer

- Pay Period Gross Wages, including allowances.

- Pay Period Gross Tax.

- A Declaration that the figures are correct.

- Identifying information such as your ABN number, address, etc

This will pre populate W1 and W2 on your BAS statement.

Employee

- Year To Date Gross Wages.

- Year To Date Allowances (if any).

- Year To Date Tax.

- Year to Date Super.

- Identifying information, including TFN, DOB, current address.

...

| Info | ||

|---|---|---|

| ||

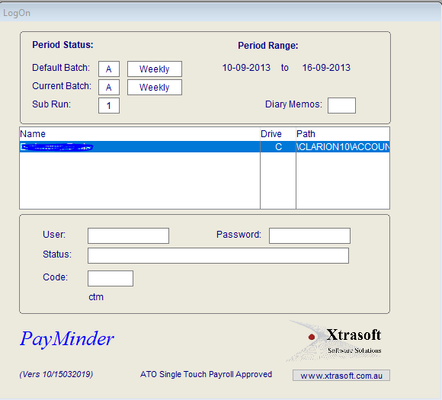

Note that the ATO requires that all access to a Payroll system is logged and prtected by 2 Factor Authentication. See the this document for further details. |

| Table of Contents | ||||

|---|---|---|---|---|

|

Assuming your are already logged into the Payroll System:-

...

1.Process the Payroll as normal

...

be it direct entry, via time sheets, or a combination. Arrive at the point where you are ready to get approval.

...

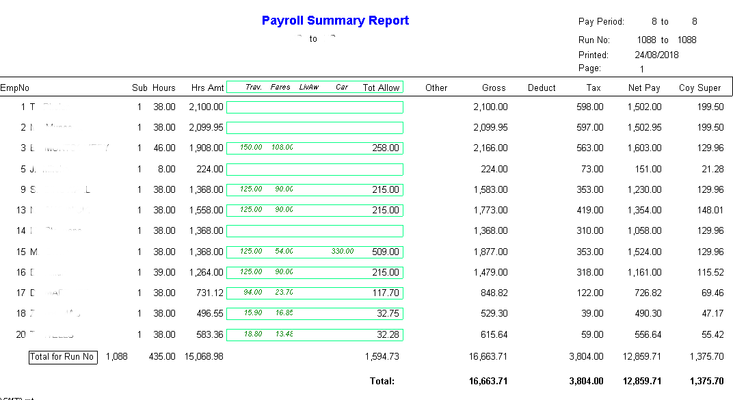

2 .Print the 'Approval' Report,

...

Normally this will be 'Payroll 3 - Pay Summary Listing'.

- Payroll

- Reports

- Report Manager - Reports

- Payroll 3 - Pay Summary Listing

- Report Manager - Reports

- Reports

...

Once you have sign off, you can proceed with the payroll.

...

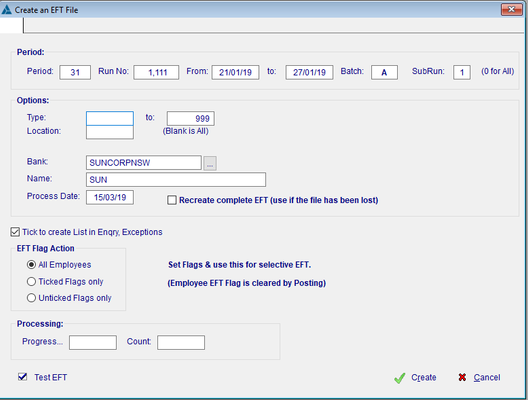

4. Produce ABA file for bank & upload. - as per normal procedure

...

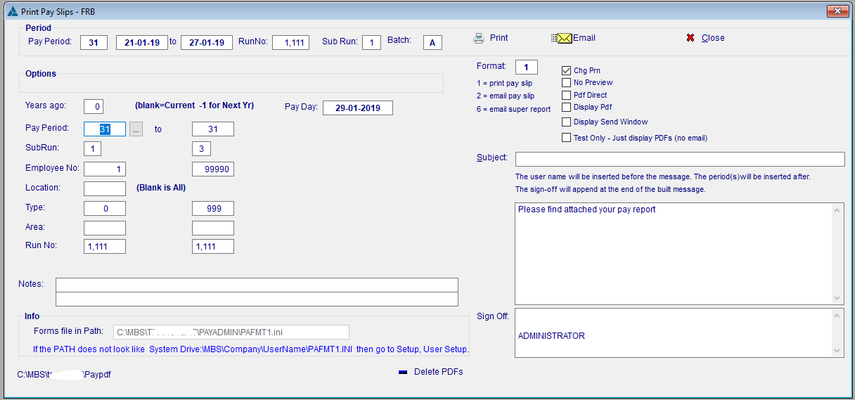

5. Print / Email Payslips - as per normal procedure

...

...

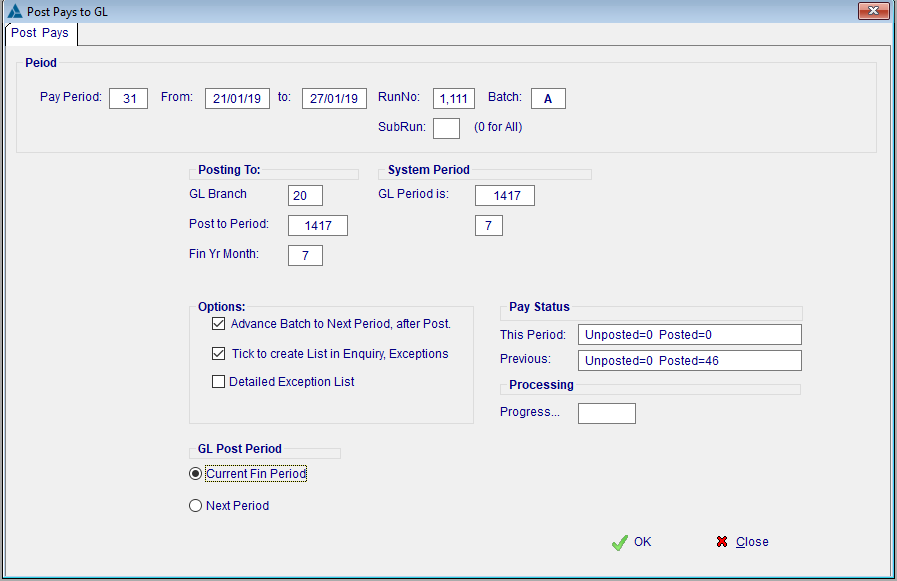

6 .Close the Pay Period.

You will have done this before, but now you cannot leave it open, it must be closed prior to processing STPSingle Touch Payroll.

- Select 'Post+Advance Pays'

...

7 Single Touch Reporting

Once the Payslips are run, the ABA file has been uploaded to the bank & the Pay Period is closed, we can now commence the new part of the process.

- Click on Single Touch Payroll

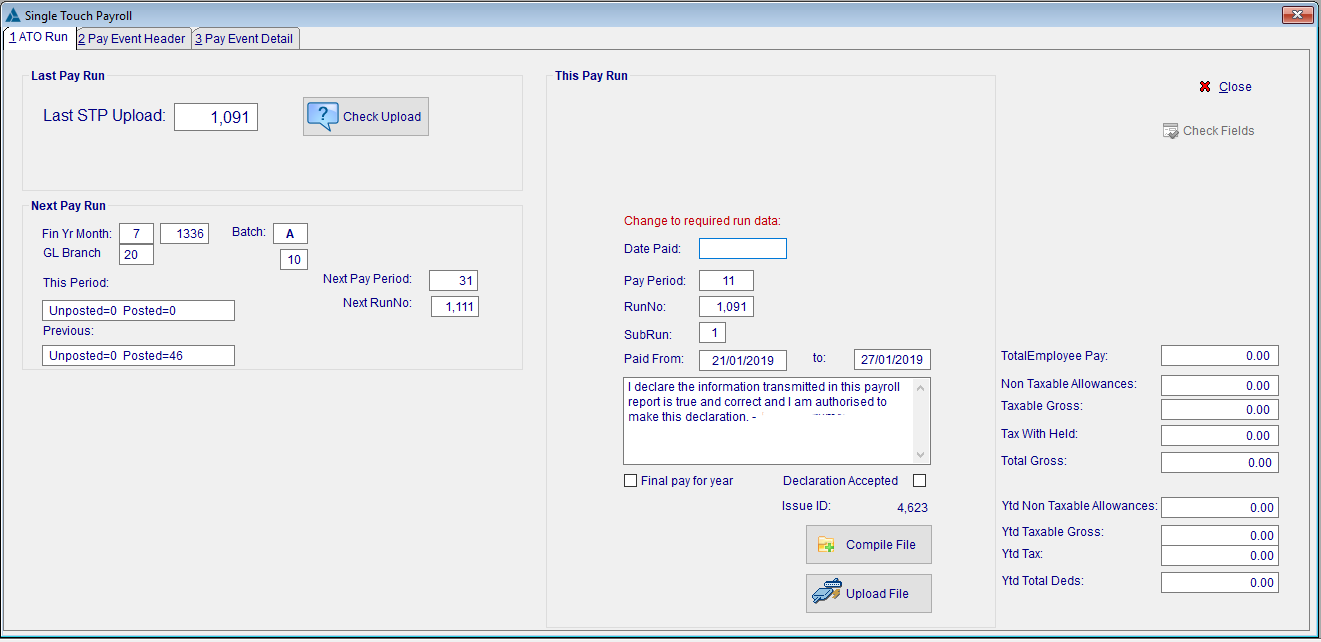

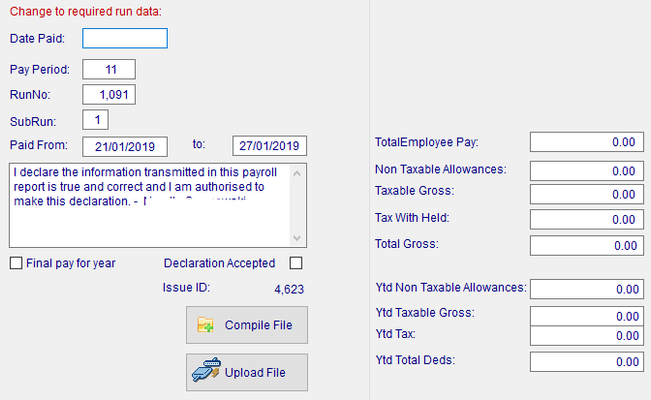

The screen is broken up into 3 sections.

...

Last Pay Run.

You can Check the status of your last upload here.

...

Next Pay Run.

This is a double check that you have CLOSED the Pay Period

...

It also gives you a clue as to what should be in the following section (ie the Pay Period & Run No should be less 1!)

...

This Pay Run

You must set the following:-

- Date Pays Paid → The date your payroll arrived at the bank.

- Pay Period → The current Pay Period

- From / to → The Pay period from / to Dates

- Declaration Accepted → Tick if you agree with the Declaration

...

8. Compile the File

Once those fields are OK, you can then press 'Compile File'

This create creates the file & produces the actual Payroll report that is sent to the ATO in the next step.

...

This should equal your previous Payroll Reports.

...

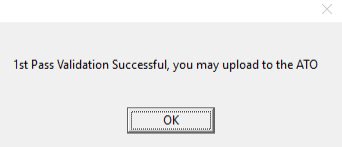

9 Upload to ATO

Now Click on the 'Upload File' button

...

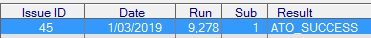

The browse box will display the status of previous submissions.

- If all goes well, you will get a successful Validation.

If the Validation is Successful, then the file will be automatically submitted to the ATO.

...

The Message you are looking for is 'ATO_SUCCESS'.

10. Procedure Complete

...

Possible messages are:-

"INVALID_API_REQUEST"

...